Media | Articles

Lambo leaks next supercar, Hertz/Uber tie-up travels to Europe, car loans out of control

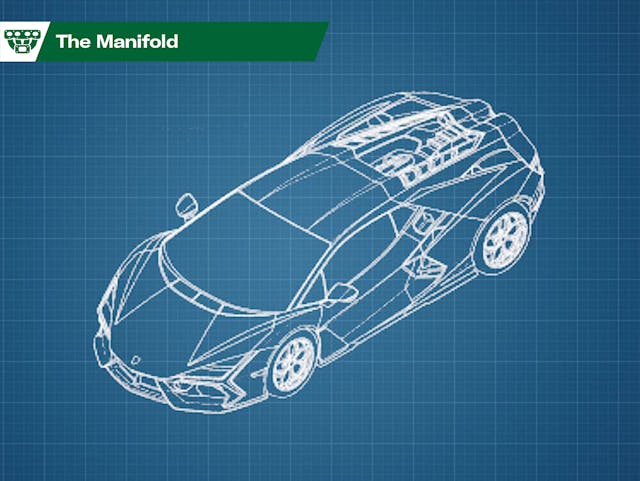

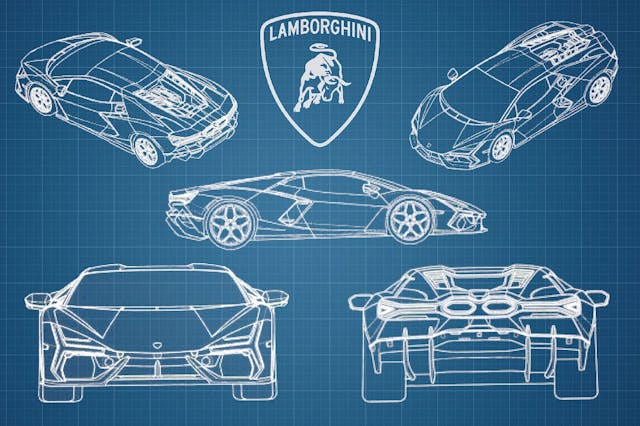

Patent pics show Lamborghini’s Aventador replacement

Intake: Line drawings filed with the World Intellectual Property Organization (WIPO) seem to reveal the outline of Lamborghini’s next supercar. Destined to replace the Aventador, the design is more evolutionary than revolutionary, taking cues from the Centenario and Sian specials. The front end seems especially similar to the Sian, while the rear diffuser definitely looks like the one that debuted on the Centenario. Also visible from the drawings are the Y-style rear lights and the engine’s position right behind the occupants. The name of this next raging bull isn’t confirmed but a previous trademark for “Revuelto” could well appear on its rear.

Exhaust: Lamborghini is sticking with a normally-aspirated V-12 for as long as it can, although this new creation will feature hybrid technology. Most likely that will be in the form of the supercapacitor system that was previously fitted to the Sian and reborn Countach, which should give the new car around 800 horsepower. Lamborghini clearly didn’t want this news getting out as the patent filing was made in North Macedonia and the images have now been removed from the WIPO website. A March unveiling will reveal all, however. — Nik Berg

Hertz, Uber, take tie-up across the pond

Intake: Hertz and Uber have pronounced their partnership in North America to be such a success that the two companies are joining forces to do the same thing in Europe. Hertz claims that the partnership here has already “benefited tens of thousands of drivers on the Uber platform. To date, nearly 50,000 drivers have rented a Tesla through this program, completing more than 24 million fully-electric trips and over 260 million electric miles.” The two companies announced today that they’ll do the same in Europe, in which Hertz will make up to 25,000 electric vehicles available to Uber drivers in European capital cities such as Paris and Amsterdam by 2025. The vehicles will include Teslas and Polestars.

Exhaust: It’s an interesting way to give a lot of potential customers their first taste of riding in an electric vehicle. Teslas typically have high resale value, so when Hertz goes to sell the rented Teslas later, it should come out on top. “The partnership is a key element of Hertz’s strategy to build one of the largest fleets of rental EVs in the world, and Uber’s industry-leading commitment to become a zero emissions platform in North America and Europe by 2030.” Uber advertises to its drivers that they can rent a Tesla for $334 a week, which seems pricey but there are incentives involved. – Steven Cole Smith

84-month car loans “surge” in popularity

Intake: Eighty-four-month auto loans have “soared in popularity among new vehicles and more than doubled on used vehicles over the past five years, credit bureau data show.” Automotive News cites a study by Experian, the credit bureau organization, that says that as of the third quarter of 2022, nearly one-fifth of all new-vehicle borrowers and a tenth of all used-vehicle borrowers were committing to seven years of debt on their vehicle. This has changed dramatically over the past five years—the study says that in the third quarter of 2018, only 11 percent of new-vehicle borrowers and 4.1 percent of used-vehicle borrowers “were on the hook for 84 months, according to Experian. By the third quarter of 2022, 19 percent of new-vehicle debt and 11 percent of used-vehicle loans ran seven years.” Another 1 percent of new-vehicle and 0.3 percent of used-vehicle loans during the third quarter of 2018 had even longer terms. Five years later, those proportions had grown to 1.8 percent for new vehicles and 0.9 percent for used models.

Marketplace

Buy and sell classics with confidence

Exhaust: We can’t read this study from Experian without thinking of the term “upside down,” which occurs when you owe more on your loan than your car is worth. There was a time when 36 months seemed like a stretch, then 48, then 60, then 72, now 84. What’s next, 96 months? Before you sign those documents, be sure this is a vehicle you want to live with for a long time. Otherwise, be prepared to pay the piper. — Steven Cole Smith

Seavey victorious in 37th annual Chili Bowl

Intake: Last week, 370 midget racers rolled into Tulsa, Oklahoma’s SageNet Center with their sights locked on winning the 37th annual Lucas Oil Chili Bowl. By the time the dust cleared, Californian Logan Seavey stood on top of the podium with a Golden Driller trophy held high above his head. To claim his first Chili Bowl title, the 25-year-old open-wheel dirt driver had to fend off a furious late charge from last year’s winner Tanner Thorson. While the victory is Seavey’s first at the historic indoor midget race, it is car owner Kevin Swindell’s fifth. Starting in 2010, Kevin—son of sprint car hall-of-famer Sammy Swindell—clicked off four consecutive Bowl victories behind the steering wheel. Then, in 2015, at the height of his driving prominence, young Swindell broke two vertebrae in a sprint car race, which left him partially paralyzed below the waist. Since then, Kevin has fielded his own entries, most recently with Seavey behind the wheel. In 2023, Kevin returned to victory lane, this time as a car owner.

Exhaust: Aside from the fan-favorite first-time winner, the big storyline at this year’s Chili Bowl was the lack of a few key entries. Previous winners and current NASCAR Cup stars Kyle Larson and Christopher Bell were noticeably absent from this year’s entry list. Out of the nearly 400 entries, only 24 start the final feature. With a couple of perennial contenders removed from the show, it opened the field and increased the opportunity for a new winner to hoist the Golden Driller. The competition was stellar and it’s comforting to know that even without the presence of NASCAR’s elite, the Chili Bowl can endure—and even grow. — Cameron Neveu

“Hey Bob, when is the 30 yr mortgage up on your Escalade?”

I am not sure when the author last rented a vehicle, but $334 for a full week in anything is a good deal. Might be time for a reality check…..

84 month loan? No way, buy the used Camry, not the new Lexus.

I work in a large regional financial in the Midwest, and we have a large indirect dealer lending operation, with nearly 300 dealership organizations partnered, and this trend towards long loans, particularly on trucks, is raising alarms with us and our peers as the recent dropping of used vehicle values is putting a number of truck owners underwater. We have limited the 84 month option to new vehicles only, and even then only if the vehicle price/value is above a certain amount, as we have reached a point of seeing that issuing these long loans does more harm to our customers than good. If you cannot afford the vehicle on a normal term, you need to be looking at a different vehicle, putting yourself into a guaranteed underwater position (on these loans you rarely get out of the underwater position until 4-5 years in) is not wise financially.

84 month loans exist because people are buying more vehicle than they can afford. At some point this has to give. Car prices just going up and up but salaries are not. Inflation is hurting the average person and somehow they are going to afford disposable toasters in the future?

I would certainly advise people to stay out of long term contracts. If you absolutely have to have another car buy something used instead. Or fix what you have.

I was in High School when the first C-2 came out, and went to the local Chevy dealer, with the serch lights buzzing, and looked at it in the show room. Being a teenager at the time, having a super powerful rush of testerone, made the hair on my arms stand up, and now this new Corvette is doing the same thing to me at almost 75 years old.

I don’t believe most buyers care how long the loan term is, they ABSOLUTELY MUST HAVE a bigger vehicle than their neighbor, cost be damned. Manufacturers are fully aware and only too happy to provide for them, and loan servicers are just as happy to rake in the interest. It doesn’t work for the more pragmatic among us but they are all getting what they want.

Don’t forget the government/regulatory causes as well. Nowadays, certain equipment that used to be optional on top trims is mandated to every vehicle (backup cameras being a great example) at every trim level. In some cases, it is more cost effective for the manufacturer to put other costly features in a vehicle to reduce their own costs to include a single feature. Again, using the backup camera example, if you have to put in the screen and wiring for the camera, you may as well put the whole infotainment system in them all rather than have to produce 2 different systems and installation lines in the factory. The end result is the baseline cost of all vehicles going up (since when does a work truck trim need an infotainment system and other bells and whistles?). On the banking side, increased regulations to be “anti-discriminatory” are in actuality making it increasingly difficult for banks and credit unions to turn down bad loans to those that cannot afford them, as it is less expensive to repo a vehicle and auction it at a loss than to fight a discrimination lawsuit for not granting the loan. End result is the ludicrous vehicle prices and the loans designed to let John Doe afford them, even when Mr. Doe is making a dumb financial choice.