Media | Articles

NADA Wants Nothing To Do With FTC Consumer Protection Rules

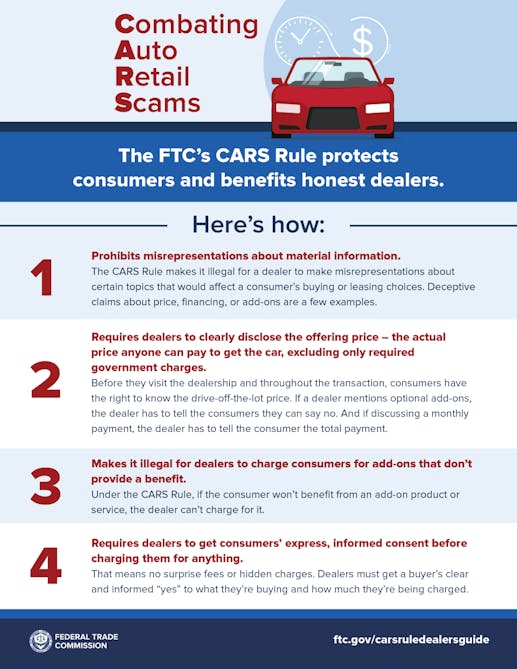

In December of 2023, the Federal Trade Commission created the Combating Auto Retail Scams (CARS) Rule to add “truth and transparency” to the process of buying a new car. The mission was clear: to eliminate “bait and switch” tactics, remove Finance and Insurance (F&I) add-ons that do not necessarily benefit the consumer, and ensure accurate pricing in dealership advertisements.

The new rules were so radical that the FTC created a handy website to help dealerships navigate the changes, complete with this snazzy infographic:

Not so fast, says the National Automobile Dealers Association. The NADA, a trade organization representing nearly 16,500 franchised new-vehicle dealerships in the U.S., is suggesting the CARS isn’t all it is cracked up to be. Via Reuters:

The FTC’s Vehicle Shopping Rule is simply terrible for consumers, adding massive amounts of time, complexity, paperwork and cost to car buying and car shopping for tens of millions of Americans every year.

NADA also says that the FTC has not explained why these changes are needed or how they will benefit customers. On January 5, both NADA and TADA (Texas Automobile Dealers Association) appealed for a review by the U.S. Court of Appeals for the Fifth Circuit (Texas, Louisiana, Mississippi). Three days later, those trade groups filed a stay on the CARS Rule, pending the outcome of the appeal by the court. In a statement, the FTC refutes the accusations:

The (CARS) Rule does not impose substantial costs, if any, on dealers that presently comply with the law, and to the extent there are costs, those are outweighed by the benefits to consumers, to law-abiding dealers, and to fair competition.

Motor 1 reports that car dealerships might also be leery of the CARS Rule because it could levy fines of up to $50,120 per offense. Considering the aggression with which the Cars Rule approaches the issue of “bait and switch,” this concern would have some validity. Vehicles often sell faster than a dealership can update its inventory management system. In my decade in the car business, that issue crept up on a monthly (sometimes weekly) basis: Some vehicles have multiple suitors at the same time, and website visitors can’t call ahead and reserve a vehicle. Online purchasing will change that dynamic, but there are still folks who insist on kicking the tires before getting banks involved. And social media is only making it harder to be a bait and switcher. Employees are encouraged to promote vehicles on their Facebook/Instagram/TikTok channels and, if they get the right feedback from a follower, they can grab the keys.

But the argument that dealerships would be worried about losing a cool 50 grand? That seems unlikely, given how much effort goes into levying the final penalty for dealership shenanigans. One such case took two years from start to finish, and the behavior of the dealerships involved reflected a pattern of willingly circumventing the FTC’s rules. Proving the presence of bait-and-switch tactics will not only be difficult, but it will also be immensely time-consuming for a defendant who must prove the status of every vehicle that winds up on the FTC’s radar. Whether the fine is large or small, nobody wants to be punished for making an honest mistake.

Marketplace

Buy and sell classics with confidence

But the CARS Rule is concerned with more than just bait and switch. It also argues that the consumer shouldn’t be pressured (sorry) to buy items like tires pre-filled with nitrogen. (Dealers usually replace the factory valve-stem covers on the tires with green-tipped replacements to show the work has already been performed.) For those who haven’t been suckered into such a situation, nitrogen-filled tires supposedly reduce oxidation and hold pressure longer. But tires usually oxidize/degrade from external forces quickly enough to make the first argument irrelevant, and the second one doesn’t necessarily hold water.

We will keep an eye on how the Court of Appeals handles this one, because CARS Rule could become a whole lot of nada, if the dealer groups have their way.

***

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.

Multiply the number of cars sold in the US by the number of years dealers have been selling cars and you should arrive at a reasonable approximation of the number of reasons these rules are needed.

Yes considering that the dealer does this all the time, a customer is a babe in the woods with a one time purchase. The fast talking take over man blasts through disclosures and slips in the add ons so you don’t know if you agree or not when signing the 3 foot long contract. This is good to slow them dow.

I just commented in another post about how I have never purchased a new car and there isn’t much encouragement out there for me to start now

This “could become a whole lot of nada” – I see what you did there…. 🫡

Nothing wrong with buying a new car. But you do need to do your home work and you do need to have some common sense.

Too many people walk into dealers with out a clue to anything and they are price for the rip off dealers.

I walk in I know what I want, I know what I should pay, I know what I should have for a trade and documentation.

Most people can learn much from the many videos on the web anymore. But yet they walk in cold and get taken.

My last purchase of my sons new car was the best I did not have to deal and beg and they gave me a great deal right from the start. We saved $7200 off sticker and did not have to play games. Some dealer still do it right.

“The FTC’s Vehicle Shopping Rule is simply terrible for consumers, adding massive amounts of time, complexity, paperwork and cost to car buying and car shopping for tens of millions of Americans every year.”

This has got to be some of the best comedy writing I’ve seen in a long time! Someone needs to explain to me how telling a consumer that they don’t have to buy your B.S. adds “massive amounts of time, complexity and paperwork” to car buying. In the worst-case scenario, the dealer need only have the customer sign a form that says, “I’ve been told that True Coat doesn’t actually do any good, and I’m not required to purchase it, but I’m buying it anyway.” 😆

I know bait and switch and all sorts of tricks can be a problem and yet I do wonder how much the FTC can do that will actually help.

Back in the late ’80s, I was helping a friend who was buying a new Hundai from a New Orleans area dealership. A car was selected and the sales contract written up. I stopped the salesman and asked about the charge (~$200, as I reacll) for paint and fabric protection. When I told him my friend did not want that, he said the protection is already on the car – it is done when the car first comes in. I told him to take it off. The car my friend selected still has the plastic covering over the seats. The salesman was flustered but did comply and remove those junk charges.

Unfortunately, some people don’t realize that they, a buyers, have a powerful negotiating tool called their feet. I have 2 different friends who had negotiated a price for a vehicle, only to have the dealership come up with extra charges when they walked in to sign the contract. They both walked out of the dealership, and purchased the same model for a better price elsewhere. In one case, my friend told Dealership B what had happened at Dealership A, so Dealer B called Dealer A and asked if they could do a vehicle swap. My friend ended up buying the actual vehicle he had negotiated for at Dealer A for a better price from Dealer B.