Media | Articles

Insider Insight: The market for modern classics isn’t as wild as you think

Vehicles built in the 1980s, 1990s, and 2000s have been the darlings of the collector car market in recent years. They appeal to new generations of enthusiasts, who are entering the market en masse, and have benefited hugely from the growth of online auctions. But how hot are these vehicles, really? Sure, modern classics seem to set new price records every week, but a handful of sales—no matter how buzz-worthy—aren’t sufficient data to judge an entire segment. To untangle the hype from real appreciation, we researched the data behind repeat sales of modern classics.

With repeat sales, we focus on how the same set of cars—down to the exact VIN—sold over a period of time. The chief benefit of looking at repeat sales, versus all sales, is that they provide an apples-to-apples glimpse at price changes. Looking at all sales, in contrast, can be misleading because cars of varying quality can come to market from one year to the next. For example: Let’s say an exceptional Boss 302 sells for an unprecedented price one month. Over the next several months, that remarkable price draws poorer-quality Bosses to the market. If the prices they achieve are appropriate for their condition and lower than the first seminal example, did values for the model tank? No. But good luck parsing that unless you know the condition of every car that sold.

We account for this in our Valuation guide by providing four different values based on condition. Most collector cars (unlike new and used cars) don’t change condition dramatically from one sale to the next. That’s particularly true for modern classics, which are still less likely than older cars to get ground-up restorations between sales. There are plenty of these transactions. (The oldest of our “modern” classics are approaching 40-years old and, consequently, plenty of them have been bought and sold at auction many times in the past twenty years.)

Compiling this data is not without its challenges. The first being that we must define what is a modern classic. While there’s room for debate on any era of classics, older cars benefit from sheer seniority. (A ’53 Bel Air with a Stovebolt six is neither fast nor very valuable, but just about anyone who sees one drive down the road would identify it as a classic.) Newer cars demand a more discerning sniff test—we’ve included in our analysis vehicles that seem to excite enthusiasts. That doesn’t mean we only picked supercars; the index also includes affordable roadsters and practical sport sedans, as well as SUVs and hatchbacks. Just about every major automobile-producing country is on the list, except for France, which shows their absence from the North American market in past 25 years isn’t helping their collectibility. Almost every engine configuration and location are present. Hybrids and electric vehicles are too new for this list, though.

Here is our list:

Marketplace

Buy and sell classics with confidence

Acura NSX (1991–2005)

Alfa Romeo SZ and RZ

Alfa Romeo 8C Competizione

Aston Martin DB7

Aston Martin DB AR1

Aston Martin Vanquish (2001–05)

BMW M3 (E30)

BMW M3 (E46)

BMW M5 (E34)

BMW M5 (E39)

BMW Z8

BMW M Coupe (1998–02)

Chevrolet Corvette ZR-1 (1990–95)

Chevrolet Corvette Z06 (2001–04)

Chevrolet Corvette Z06 (2006–09)

Dodge Viper (1992–02)

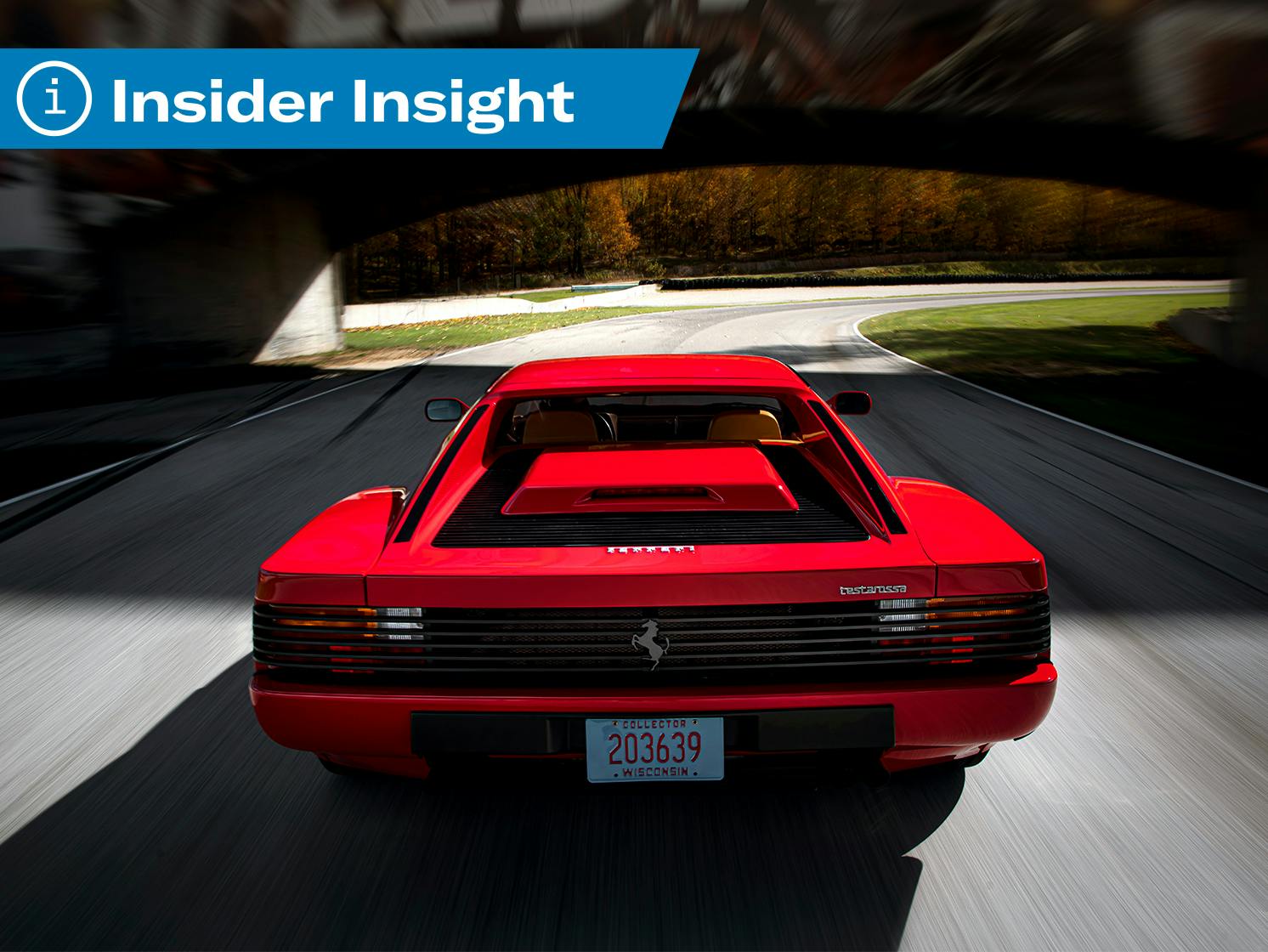

Ferrari Testarossa

Ferrari 512TR F355

Ferrari 550 Maranello

Ferrari 550 Barchetta

Ferrari 575M and 575M Superamerica

Ford GT (2005–06)

Ford Mustang Shelby GT500 (2008–14)

Ford Mustang Boss 302 (2012–13)

GMC Syclone (1991)

GMC Typhoon (1992–93)

Honda S2000

Lotus Elise (2005–10)

Lamborghini Countach (1985–90)

Lamborghini Diablo

Lancia Delta Integrale (1987–93)

Mazda Miata NA (1989–97)

Mazda RX-7 FD (1993–02)

Mercedes-Benz 190E 2.3-16 and 2.5-16

Mercedes-Benz 190E Evolution I and II

Mercedes-Benz 190E 500E (1990–94)

Nissan Skyline GT-R R32 (1989–02)

Panoz Esperante (2000–07)

Plymouth Prowler

Pontiac GTO (2004–06)

Porsche 911 (964)

Porsche 911 (993)

Porsche 911 GT3 (996)

Porsche 911 GT2 and GT3 (997)

Porsche 928 (1987–94)

Toyota Supra ’93 – ’02

Our selection process yields a large dataset of some 835 matched transactions. Lots of data generally means better conclusions. We can more easily exclude questionable sales—say, a car sold multiple times by the same auction company in a short period—and those outliers that slip through have less impact on our results.

Our conclusion after analysis is, chiefly, that the overall market for modern classics isn’t as wild as the headlines (ours included) sometimes make it seem. Repeat sales of modern classic vehicles over the last 20 years shows a run-up in the mid-2000s, followed by a long decline until late 2010 (when the entire collector car market rebounded), a mostly steady performance over the last decade, and a rise beginning in 2019. That isn’t all that different than we see when we study muscle cars, thought to be a far more mature segment.

In comparison, a 12-month trailing average price of those same types of modern vehicles—but not just those that have sold twice—races towards a jagged peak in 2015 then drops off (the thin gray line). The big difference between the trailing average and the repeat sale index (blue line) suggests some exceptional cars did sell for a lot—and only sold once. Other cars that have since been drawn to market haven’t sold for nearly as much, probably because they’re in poorer condition. However, cars that are of a known condition have enjoyed a solid and relatively predictable return over the same period.

It’s perhaps fair to conclude from all this that the modern classic space is not as red hot as it often seems, but keep something mind: For most of us, slow and steady growth is a good thing. It means you can buy a modern classic, drive and enjoy it for several years, and be reasonably sure you’ll get back what you paid and then some when it comes time to sell. In other words, the market for modern collectibles is growing up.

Want a deeper dive and, perhaps, more charts? Check out the full story at Hagerty Insider. For a dose of collector car analysis in your inbox every Sunday, sign up for our newsletter.