Media | Articles

Virtual roundtable: Industry pros on the state of the collector market

As much as we value our data and charts here at Insider, a healthy dose of observation and opinion does help us keep our bearings. The collector car market may have receded from its pandemic-era volatility, but we’re still processing how the superheated market of the last three years is beginning to settle out. To help us better understand this state of affairs, we sought out some industry professionals to hear what they think.

Spring is in the air

In the wake of frenzied, pandemic-fueled prices, more typical ebbs and flows of the market appear to have re-emerged. “There’s a bit of a springtime pick-up happening, which is in itself a type of normalcy,” said Derek Tam-Scott of Issimi. “If you go back a couple of years, for example, the market was operating completely independently of these cyclical, seasonal behaviors.”

Colleen Sheehan of Ferraris Online agrees. “At the end of last year, it got slow—really slow—for the last few months,” she said. “Things weren’t really moving. I was getting some offers along the lines of, ‘well, the market is falling, so I’ll give you $100k for that $200k car.’ But, by the beginning of this year, it picked up again.”

Both feel that rationality has returned to the market. “There’s no more of this, ‘let’s try it at $50k over and see how it goes.’ That is gone,” said Sheehan.

Calmer, more cyclical market behavior doesn’t mean prices will fully retrace themselves, though. “Some car values got jacked up, then stayed up, and have only slightly retreated,” said Tam-Scott. “It will never go back, I don’t think, to the way things were in 2019.

Bifurcated market

Though transaction behavior has mostly calmed, the top of the market is still willing to pay up. “It’s the most bifurcated market I’ve ever seen,” said Dave Kinney, Publisher of the Hagerty Price Guide. “We haven’t seen the pullback with the very expensive cars that we’ve seen elsewhere. As a matter of fact, we’ve seen additional world records paid for top cars almost on a regular basis, including this past weekend at the Mark Smith sale, where the most expensive Chrysler of all time sold.”

Mark Hyman, founder of Hyman Ltd Classic Cars, echoed that sentiment, citing activity in the prewar market as an example. “What we’ve seen is that the really great prewar cars—we’re talking the best of the best of the best, like Duesenbergs—have gone up in value a lot . But, the average pre-war car has gone down in value. A ’29 Duesenberg is worth more money than ever, but a ’29 Buick sedan is well beneath its peak value.”

This bifurcation isn’t just between the top of the market and the rest—there’s also a split between the top-condition, unique examples of a model and less rare or special trims. “The best of the best are still selling, and selling well,” said Tam-Scott. “Individuality matters now more than ever due to social media, but that’s really an extension of something that’s always been true. Unique cars lead the way, and then more garden-variety cars come up in value in a hot market because more people are hopping in. That lower tier recedes when the cheap money dries up or the economy goes.”

Kitchens and cars

“Cheap money, that great thing that funds kitchen renovations and cars, well, that’s gone,” said Kinney. “Wealthy folks don’t tend to finance these purchases—it’s always discretionary funds that they use to purchase an automobile. Interest rates could very well be why the middle and lower end of the market is a little bit of a mixed bag right now.”

“Access to debt is definitely one of those things,” agreed Tam-Scott. “We’re still seeing how that plays out in our portion of the market, especially at the top end—there’s not many who are using debt in that sphere. But yes, a lot of people who in the last couple of years might’ve just thrown caution to the wind and said ‘I’m going to borrow money to buy a Ferrari F50’ are now proceeding with caution.”

In addition to pushing some would-be buyers out of the market, Ken Ahn, President of Hagerty Marketplace, added that interest rate hikes can impact the sales side, too. People in business sectors that often rely on financial leverage—entrepreneurs or real estate, for instance— are looking at their portfolios holistically. “With interest rates going up so quickly over the past several quarters,” said Ahn, “debt service obligations are leading to ‘I don’t think I need these cars and I should sell them to de-lever’ calculations.”

Segments and models the pros are watching

Given the fractious nature of the market itself and a significant portion of potential buyers stepping back, trends within segments have become even more nuanced. Models or segments that should go lockstep with each other up or down are instead splitting, making it very difficult to make calls on the market as a whole. However, recent sales have yielded plenty of observations worth noting.

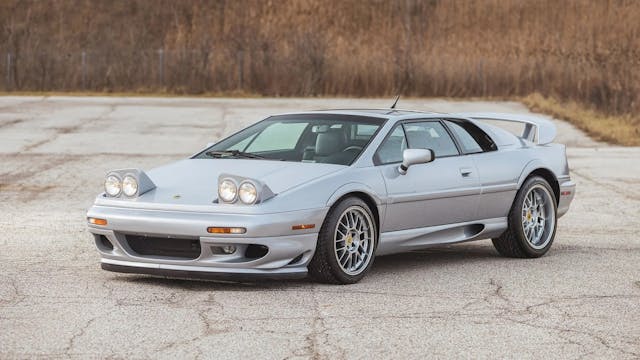

Howard Swig, President of Auctions at Bring a Trailer, shared examples that drove home how granular interest has been of late. “1953 Corvettes, 1992 Vipers—those are two examples of first-year cars that have sold very well recently,” he said. “Lotus Esprit V8s toward the end of their run in the early 2000s are an interesting little pocket that those cars seem to be at their peak currently. As far as more modern cars, two-digit and three-digit mile Dodge Demons are hot property right now.”

Zooming out, Ahn offered perspective on the much discussed old and new corners of the market. “Anecdotally, pre-war cars are much harder to sell and achieve great prices unless they’re truly special,”said Ahn. “When you have something as good and unique as a Simplex, you can achieve strong value—but that’s more the exception than the norm. 1980s/1990s cars remain exceptionally hot—as we saw at our own auction in Amelia, or as I’ve been following on online auctions. Group B rally cars, RUFs, Mercedes AMG Hammers, and BMW M-Series are all doing very well.”

The theme of old vs. new carried with Sheehan as well. “It’s a buyer’s market, but we’re seeing fewer buyers for the older cars,” she said. “There’s no lack of people who want a 275 or a 250 Lusso, but the hot ticket items are mainly coming from the 1980s through early 2000s. That is absolutely generational driven, and it’s real. Look to what our childhood cars are.”

In contrast, Stewart Howden, President of Classic Auto Mall, is selling every Model A Ford he gets his hands on. “We’re seeing more and more Model As than we ever have. We can hardly keep them in stock. It’s funny because I think that if somebody wants a true representation of the hobby and collector experience, the Model A is it.”

Another strong but subtle segment is collector trucks. “One thing that’s unique about pickup trucks is that they have value in use as well as value in place,” said Kinney. “By that I mean you can use a pickup truck, even a classic pickup truck, to actually move things. From that standpoint, it’s an easier sell in the family budget.”

Japanese-market cars were one of the darlings of the pandemic era, and interest remains strong. When asked whether increased interest rates were likely to impact the popularity of JDM cars in the U.S., Tam-Scott thought they might, but only in the short term. “The enthusiasm for those cars will always be there—the question is whether the market can enable their appreciation. That dynamic might be a little bit delayed or suppressed just because there’s fewer players in the market. But eventually those trends will materialize.”

“I’m not worried about the Skyline GT-R, or other investment-grade cars that were in video games in the early 2000s,” said Kinney. “It’s the more affordable part of the JDM market that could be softer in the short term. So many Kei cars are coming in that it’s actually keeping the price down on a lot of the lower end of the market.”

Keep dancing

When asked about whether any macro indicators posed concerns for the collector car market going forward, all acknowledged the overall uncertainty in the air but noted that they were focused on what they can control. “I think car people are notoriously bad at this. As long as the music is playing, we are dancing,” said Tam-Scott. “As a consignment business, we have less exposure than others might, however.”

Hyman noted that, if anything, the broader atmosphere has helped keep the collector market flowing. “The political and economic uncertainty makes people think differently,” he said. “Certain people say, ‘this is a good time to sell,’ while at the same time, others are saying ‘it’s a good time to buy a hard asset.’ It’s the perfect time for us to be the facilitator that people need us to be.”

Ahn took a broader perspective. “The car market has held up well relative to other assets in a high-interest, high-volatility, high probability of recession market (relative to a year or two ago), and I expect that to continue for the foreseeable future. My bet is a gradual movement along the cycle versus any abrupt changes, short of a serious external shock.”

***

Marketplace

Buy and sell classics with confidence

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.