Media | Articles

Time Machine: The 300SL helps us understand the classic car market’s past—and predict its future

With much of the world economy maintaining a defensive posture due to the threat of widespread COVID-19 infections, and the true duration of this pandemic still unknown, many people—particularly those whose livelihoods depend on in-person transactions—are in survival mode. Others, however, are planning for the future and envisioning brighter days. In the past couple of weeks, many asset classes have stabilized, and a few have even seen gains. Some view this as a buying opportunity. Owners of collector cars are no different. After all, collector car values have done well following the past couple of recessions. Or have they? The answer to that is complicated.

As Dave Kinney wrote last week, the collector car market was not always as transparent as it is today. As recently as the Great Recession, transactions were not recorded comprehensively, nor were cars conditioned as frequently as they are today. Few indices captured how values changed over time. A market without that transparency has a wide spread between what is asked and what is offered. That spread only grows wider during times of uncertainty. Panic selling becomes much more likely. Today, however, we have more data than ever, including more historical data, which means the market is more transparent than it has ever been.

All of that accumulated transaction data helps, to some degree, to fill in what happened in the past. One way to see how values behaved in past recessions is to use an index. Hagerty has several based on price guide values, but those only go back to 2006. Auction transactions go back much further, but a moving average or a moving median only goes so far in comparing what happened 30 years ago, because interests have changed so much over time. The top seller of an auction in 1990 might have been a 1914 Rolls-Royce Silver Ghost, but today, it is likely a Ferrari with a 3-liter V-12.

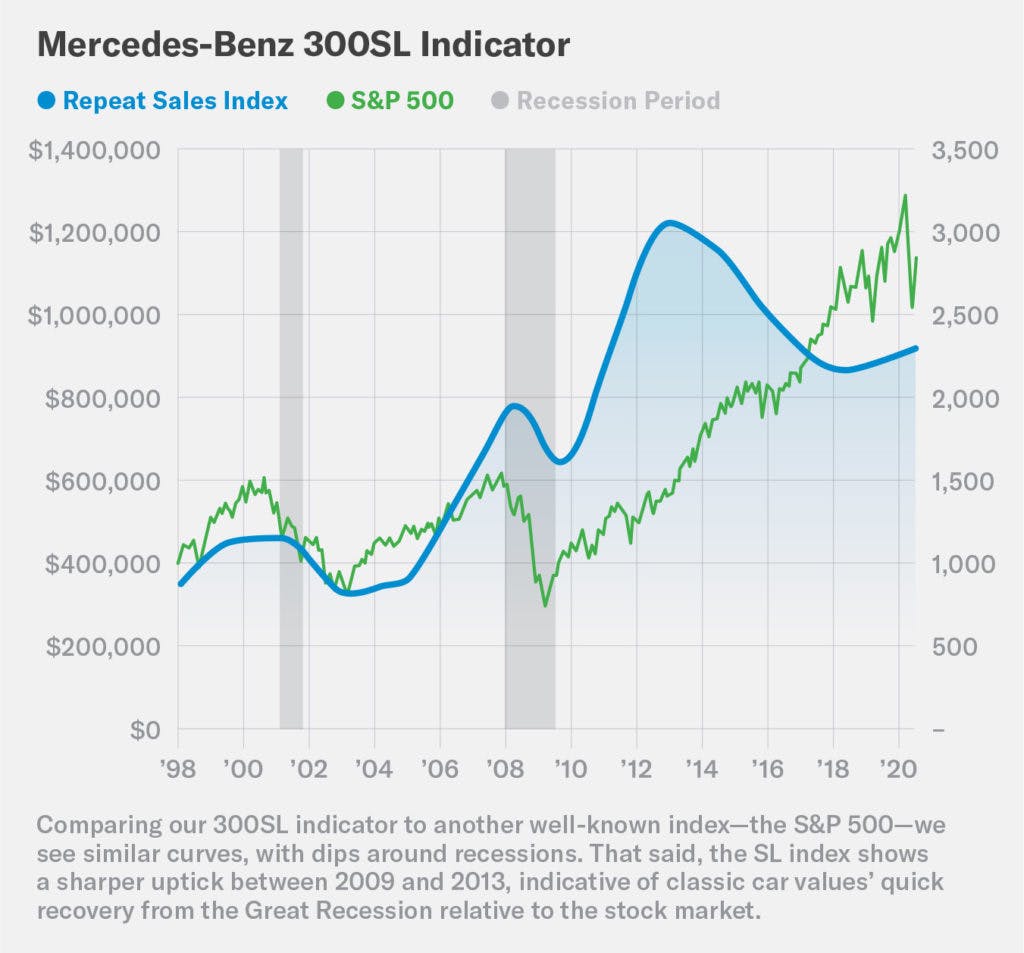

For an apples-to-apples comparison, you want a repeat sale index. A car that sold five or ten years ago and sells again today says a lot about how the market has changed in the interval. It also avoids inappropriate comparisons, such as when a 1957 Porsche 356A Speedster restored to concours standards sells for less than what a barn-find 356A Speedster sold for last year. However, this type of index requires compiling hundreds or thousands of those paired or repeat sales to produce a nearly continuous gauge of market values. Fortunately, there is one car that has longevity in the market and broad appeal: the 1954–1963 Mercedes-Benz 300SL.

We have looked at the 300SL Indicator in Insider before. As a reminder, indicators hint at a likely upcoming shift, just as your car’s turn signal indicators notify other drivers of an upcoming lane change. The stock market has many of these—unemployment numbers, inflation figures, earnings reports from key companies. We generally use indicators to peer into the future, but they can also be used to study the history of a given market. That’s particularly true for the 300SL Indicator, given that the car has been considered collectible from the time it was new and has never gone out of style. Now, after much scrubbing of historical transactions (thank you, Daimler-Benz, for using logical chassis numbers), we can use it to shine a light on the collector car market of the past and possibly to understand better how the market will perform in our present crisis.

Marketplace

Buy and sell classics with confidence

Long-term observers of the collector car market will note that the index does not cover the bubble of the late 1980s. Auction transactions for that period have either insufficient detail or are too few to provide a clear, reliable picture. However, by the late 1990s, around the time of the dot-com boom, the resolution gets much better. The index shows values peaking in January 2001 and then beginning a sharp decline after September 11. The index fell for the next 18 months, bottoming out around the U.S. invasion of Iraq. From peak to trough, the index lost almost 30 percent.

The housing boom of the mid-2000s was a period of strong price appreciation in the collector car market. Between 2005 and 2007, the 300SL index increased more than 2 percent every month. The index peaked in March 2008. However, this time, it fell for just 17 months and lost only 18 percent of its value. For comparison, one of the best-known stock market indexes, the S&P 500, lost more than 50 percent of its value from late 2007 to early 2009.

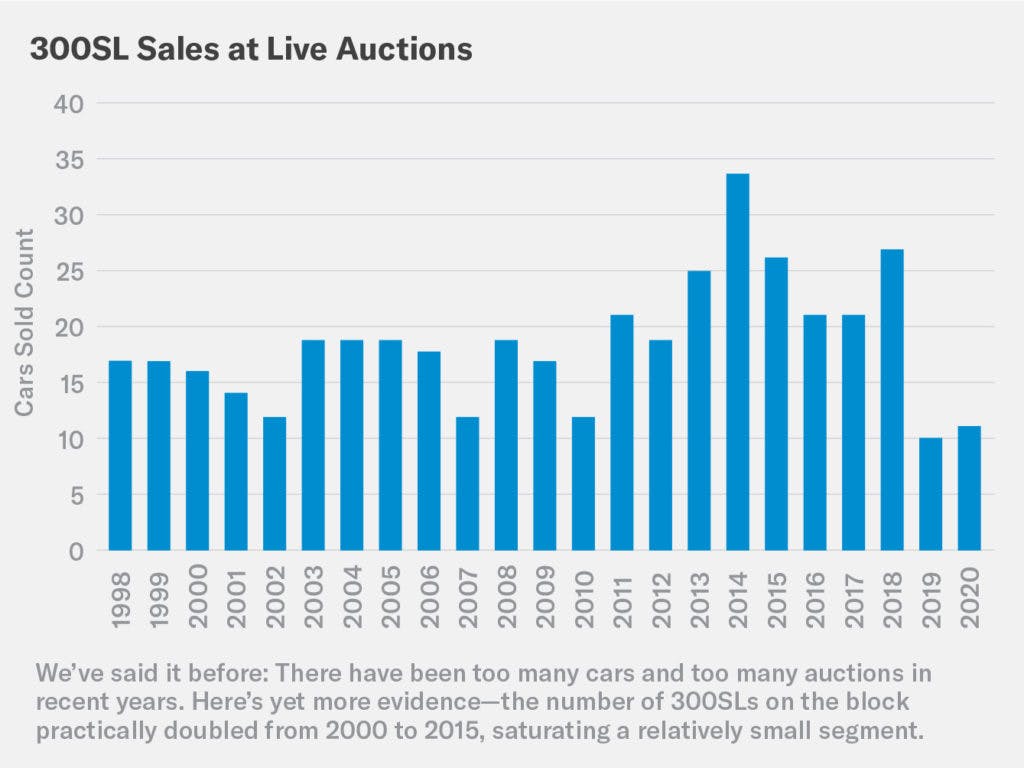

One surprise in the index: It peaked in late 2012. Insider has not been shy in pointing out, even before the present crisis, that the classic car market had cooled. The 300SL index tells us it had been cooling for seven years!

Note that while the index was declining, the average sale prices of SLs kept increasing. While more data might change this picture, it likely shows that after the period of real price appreciation that began in 2009, poorer condition cars were bid up beyond appropriate values during the frenzied buying of 2013 and 2014. The peak in the number of cars sold in 2014 suggests people were buying and selling 300SLs as quickly as possible. SLs coming out of long-term ownership or those that were “new” to the market (e.g., a barn find) continued to drive average sale prices up, but those bought from 2009 to 2012 and then flipped saw losses. In other words, the SL indicator previewed what was to happen to the rest of the market—too many cars for sale, not enough great ones.

So, a key takeaway from the 300SL repeat sale index is that regardless of what the economy was doing, the collector car market was already in “recession,” albeit a mild one, since 2012. A second observation about the recent performance of the indicator is that values were gradually trending up from a low in mid-2018.

Of course, the biggest question is whether the indicator—and the classic car market it represents—has performed well during recessions. The answer is a qualified yes. The SL index tended to soften for about a year and a half during previous recessions, but dropped less and recovered faster than the S&P 500. Whether that holds in the current economic environment remains unknown, but the data tells us a recession has historically been a good time to buy high-dollar classics, especially if you factor in the fact that cars always perform better than other asset classes on an enjoyment-adjusted basis.