Media | Articles

The collector car market in 2020: Looking back on the year we’d all rather forget

The last year has been a wild ride, to put it mildly. We’ve faced a pandemic and a recession, with a hotly contested presidential election thrown in for good measure. The effects have radiated everywhere, including the collector car market. By far the most visible effect has been the cancellation of most large, in-person auctions since the Amelia Island Concours in early March, with online platforms old and new rushing to fill the breach.

Throughout 2020, we at Hagerty Insider have been following the changes with two major questions: Could the online auctions really make up for the missing land sales? And how would the changes in the auction world impact classic car values overall?

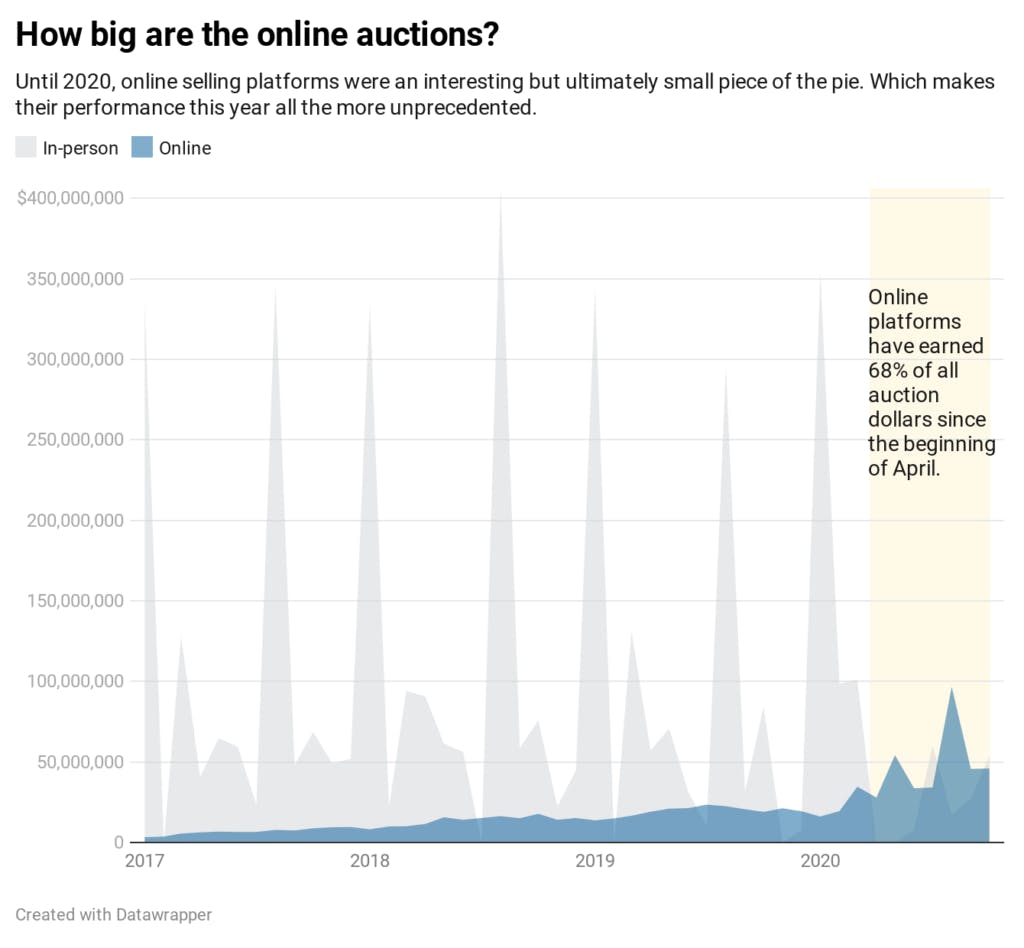

To answer those questions, it helps to have a sense of how these pieces fit together. From 2017 to 2019, classic car auctions averaged about $1.3 billion in sales. Online platforms accounted for something like 12 percent of those dollars, with in-person sales accounting for the rest.

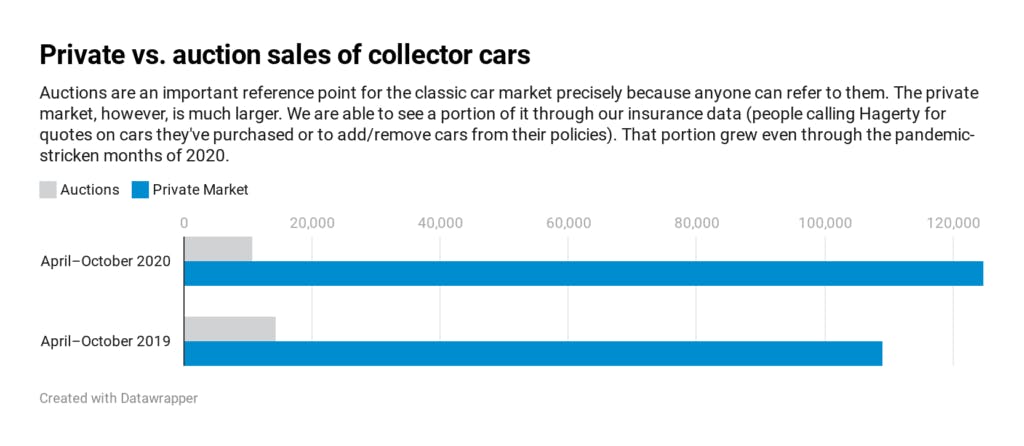

Both were eclipsed by the private market, which includes classic car dealers as well as peer-to-peer sales. It’s difficult to put a dollar figure on this market, but it’s safe to say it’s huge. Data from the insurance side of our business tell us at least seven cars are purchased privately for every one bought at auction.

Marketplace

Buy and sell classics with confidence

Those who are accustomed to associating the classic car market with in-person auctions would be forgiven for thinking 2020 was apocalyptic. Many headline sales, like Techno Classica Essen in Germany, were cancelled outright while others converted to online affairs that moved far less metal. For instance, the online sales that filled in for Monterey Car Week were down some 50 percent from August 2019.

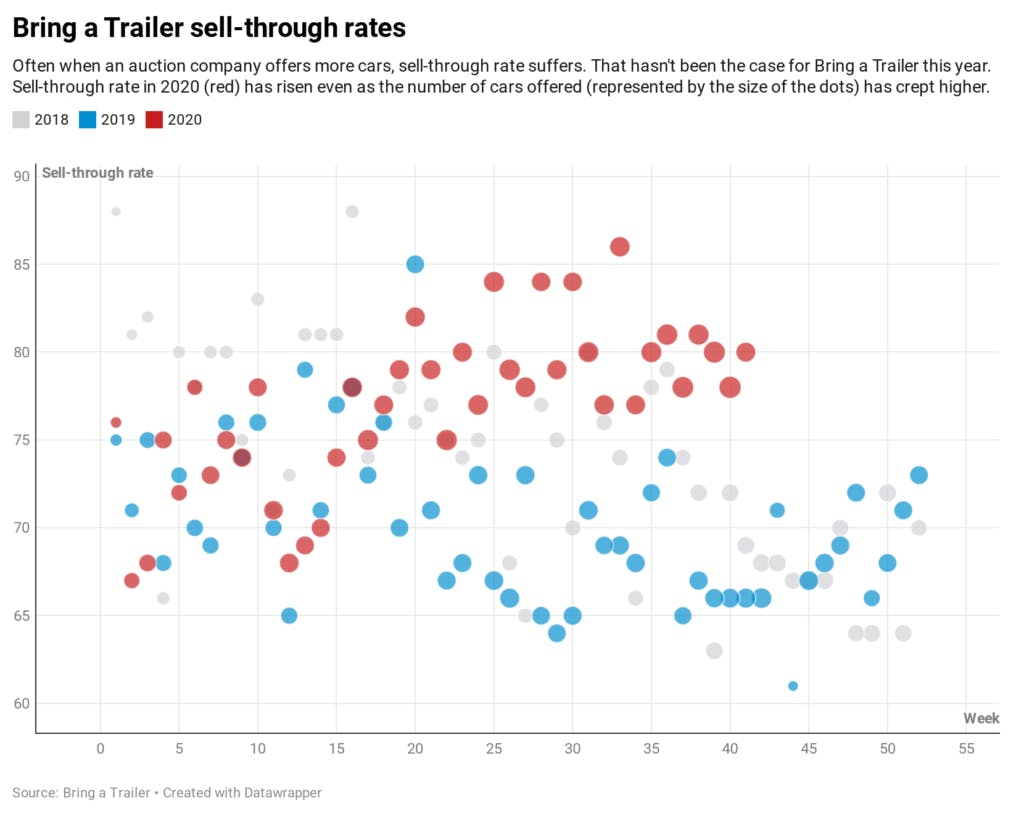

Yet such stark comparisons ignore the fact that online selling platforms don’t operate solely when in-person sales are on the calendar. In 2020, we saw a quickening drum beat of daily auctions. The most prominent example of this growth is Bring a Trailer, which has gone from offering fewer than 5000 lots in all of 2017 to offering more than that every six-months. Despite this increase in the number of lots offered, Bring a Trailer’s sell-through rate is better than it has been in the past two years. Other online platforms, like Porsche-focused PCARMarket, have likewise expanded their offerings even as new competitors, like CarsandBids.com, join the fray.

Traditional auction companies, meanwhile, have mostly continued to cluster their listings into discrete events but were able to pack many more of them onto the virtual calendar than they’d have been able to in an in-person format. RM, for instance, was able to stand up nearly half a dozen online sales in the dog days of summer, when normally it would have been concentrating its firepower on Monterey.

Overall, online platforms’ share of sales grew from less than 12 percent of all auction dollars at the beginning of 2020 to more than 68 percent since the beginning of April. As a result, total auction sales through October 2020 were depressed but not catastrophically so, down some 13 percent compared to years prior.

Then we have the private market. In contrast to the auction world’s contraction since April, transactions in the private market have increased over the same period.

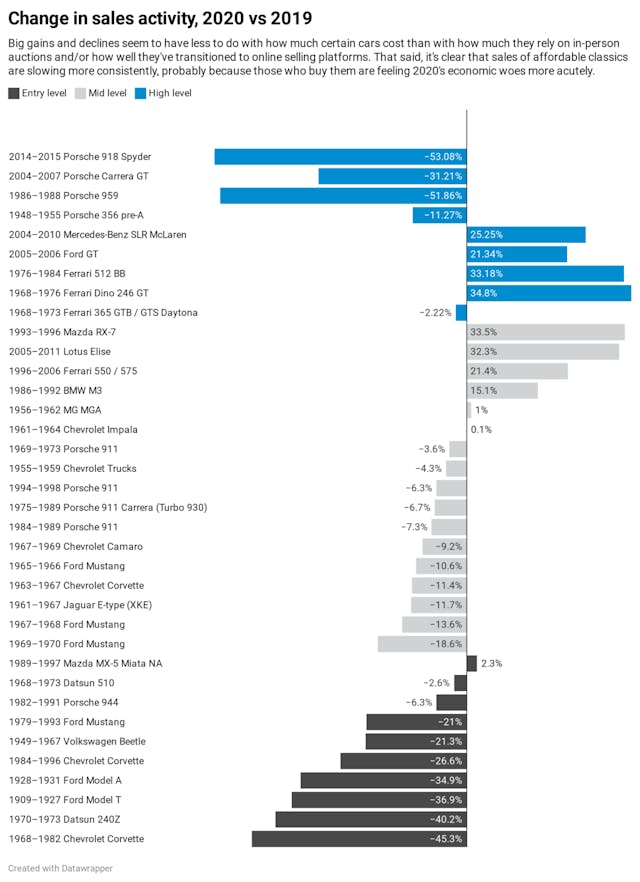

All this might lead you to believe the changes in the in-person auction world are a tempest in a teapot. However, when we look at sales—both auction and private—for specific eras and segments, we begin to see their imprint. For instance, sales of several 1960s-era classics have slowed considerably. First-generation Camaros and Mustangs still sell at a rate of thousands per year, but their numbers have slowed by nearly ten percent compared to 2019.

In contrast, vehicles of the 1990s are having a moment: Gen-Xers and Millennials have bought more $100k+ vehicles from this decade in the past several months compared to the 2017–19 period.

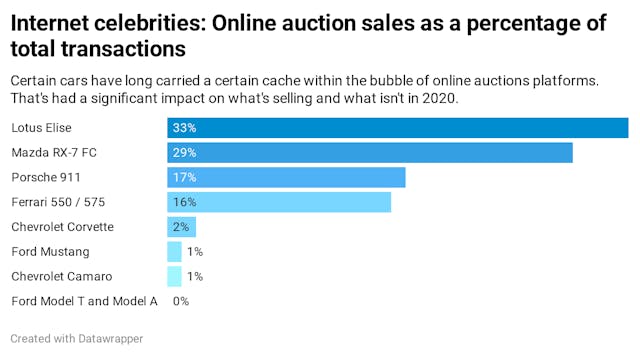

These differences in fates can be explained at least in part by how reliant particular cars are on in-person auctions and the degree to which they’ve migrated to online platforms. To wit: Big land sales accounted for more than 10 percent of first-gen Camaro sales in 2019. In 2020, that figure dropped to 0.1 percent, yet the remainder of those cars didn’t find their way to the internet, which made up 4 percent of the model’s sales this year. In contrast, online auctions accounted for over a third of all sales of Lotus Elises and sixteen percent of sales of Ferrari 550 / 575s.

The correlation between a car’s online popularity and overall sales seems to hold no matter the price range. For instance, several Porsches that typically sell in the six-figures have slowed to varying amounts, while sales of two big Ferrari models—the Ferrari 512 BB and Dino 246 GT—have picked up their pace this year. Notable interlopers are the Mercedes-Benz SLR McLaren and the 2005–06 Ford GT, which are both selling more briskly in 2020.

In the heart of the market, even as sales of muscle and pony cars have slowed as if someone added smog controls, vehicles less reliant on in-person auctions, like rear-engined Porsches, have been hurt much less, and a few drivers cars have sold faster.

At the entry-level side of the enthusiast vehicle market, there is a more consistent direction: down. Sales of the first-generation Miata—another favorite of online platforms—have picked up, but many other vehicles, from fourth-generation Corvettes to Ford Model Ts, have slowed considerably. An overall slowdown in the economy is likely playing a role here, but it also doesn’t help that such affordable classics vary greatly in condition and thus don’t lend themselves to sight-unseen purchases.

What we have, then, is a collector car market that is relatively stable overall but is, upon closer examination, remarkably different from just a year ago. Online auctions have effectively taken the place of live auctions for many vehicles, and have left other popular models out in the cold.

Note that all these changes in sales rates have not yet translated into movements in price. If in-person auctions are able to return safely in a big way next year, it’s reasonable to expect they’ll draw plenty of muscle cars and the people who love them. For now, buyers and sellers of these sort of classics are hoping that the situation we’re facing now, daunting as it may be, is temporary. That hope is something we can all toast to for 2021.