Media | Articles

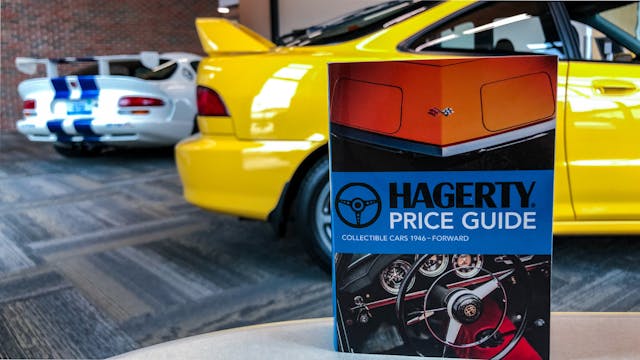

How the Hagerty Price Guide is made

Here at Hagerty, we are commonly asked how we produce the Hagerty Price Guide values that we publish online at Hagerty Valuation Tools. Some people assume it is an algorithm derived from insurance values. Others believe it is an average of auction sales. In an effort to bring better clarity to the answer, this article describes our methodology. But first, some context.

The Hagerty Price Guide was founded in 2006 as Cars That Matter, when it was a small, pocket-sized booklet covering the high points of the postwar collector car market. Today, the guide has grown to include more than 40,000 entries covering all manner of collector cars, trucks, and motorcycles from both the pre- and post-World War II eras. Our first book contained 240 pages of pricing; our last contained 612.

The values we publish are, well, a guide to collector car values in the North American market. (We also publish a price guide specifically for the British market, and another for the German market, but that is a post for another day.) Due to varying circumstances, cars can and do sell for prices higher or lower than what we publish. A unique combination of options, a compelling history, an excellent presentation, or the right people in the room on a given day can result in exceptional prices. A poor presentation, an incomplete history, a motivated seller, or a general lack of visibility can cause a car to sell well below expectations. Regardless, the Hagerty Price Guide is designed to give you a fundamental idea of how much you can expect to pay for a vehicle when buying, or how much you can expect to earn for a vehicle if you’re selling. Your individual results may vary.

The underlying foundation of the Hagerty Price Guide is the data we collect and analyze. But this analysis and interpretation is still a high-touch, human-centered process. We routinely compare aggregated sales results to our current price guide values to gauge market movement, but we also work hard to understand the context of sales individually to put the overall picture in better perspective. Following are some of the data we use to put it all together.

Auction results

Auctions are without a doubt the most visible way to sell a car. As car enthusiasts, we’ve all watched a Barrett-Jackson or a Mecum auction on prime time TV, or sat in on the comments as a Bring a Trailer sale ended. The great thing about auctions is that there are often an abundance of pictures, a detailed description of the car, and posted results. This is great because you usually have a very good idea of the spec and quality of car you’re looking at (although it is important to keep in mind that descriptions are usually overly positive). Hagerty’s price guide team goes a step further by reviewing thousands of cars in person, taking note of overall condition and often recording detailed assessments of the condition, options, and provenance. This allows us to break down the results of the sale as it relates to the broader market and the activity in the room. It also allows us to account for an over-abundance of highly optioned cars in a given period, for example, or when a lot of cars in lesser condition come to market all at once.

The catch with auctions? While they are most definitely a part of the market (and one that is growing), they represent a small percentage of the collector vehicles bought and sold in a given year.

Peer-to-peer sales

Peer-to-peer sales are the biggest sales channel in the collector car market by a huge margin. When we say peer-to-peer sales, we’re talking about an owner listing their C1 Corvette on Facebook Marketplace, or someone parking their Fox-body Mustang at a car show with a “for sale” sign in the windshield, or someone selling their 560SL to a fellow Mercedes-Benz Club of America member. But aren’t these sales private, you may ask? Yes, they absolutely are! This is where being a large insurance provider comes in handy, because when a customer calls in to remove a sold car from their policy, we ask them about the car’s condition and sale price. If they choose to share that information, we track the reported price. We find that this information is accurate, too. On occasions when a client reports sales data to us for a car that has sold at auction, the prices match.

Asking prices

Hagerty also monitors asking prices for collector cars. And while asking prices are just that—an ask—they are an additional input that can signal changes in the market. Over the years we have also developed an understanding of how close sale prices track to asking prices to better interpret these data.

Dealer and broker sales

We have established a network of trusted dealers to whom we speak whenever we update our guide. Dealers are especially helpful in that they know the ins and outs of their inventory incredibly well, and know the value drivers and market shifts for the vehicles they specialize in. Their livelihood depends on it. These dealers are willing to share their view of the market, as well as information on what they’re selling and for how much. Many of the rarest, best, and most expensive automobiles trade hands through dealers and brokers, so this network helps us monitor the market for cars that rarely sell publicly.

How we tie it together

We have a team of more than a dozen full-time contributors, with experience ranging from lifelong car enthusiasts and professional analysts to accredited appraisers and concours judges. All of these contributors look at multiple data sources. To look at one piece, like auction results or asking prices, risks taking too narrow a view of the market and missing something. That is why we want to see a trend in auction sales supported by our customers’ own selling experience, and to hear our market contacts affirm that they are having a similar experience. The more data and research, the more confidently a trend can be identified or refuted.

An abundance of data helps us see past outlier sales and hone in on what is actually going on in the market. In some cases, rare or seldom-seen cars don’t have a depth of transactions to draw from, in which case we review how similar cars within the same market segment are moving.

Once a contributor has made a decision to move or not move a vehicle’s value, that contributor’s recommendations and reasoning are peer-reviewed and either reconsidered or approved. It is labor intensive, taking several hundred hours each time we update the Hagerty Price Guide. The time we invest, though, provides us with a high degree of confidence in the values we publish, and it gives you a reference to help you navigate the buying and selling process.

***

Marketplace

Buy and sell classics with confidence

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.

New to your expertise.

It is now November 2024. The following are just observations. 1) Dealers are having trouble selling specific models, especially at prices listed. Check the Web. 2). My local Honda dealer now has three Challengers, two Mustang GT on the used car lot. What?? Yep, got them in trade for Accords, civics, and CR-V. Dealer said today’s customers don’t care about muscle cars like we used to. Bailing out quickly!