Media | Articles

Are happy days ahead for 1950s classics?

The collector car world is going through a dramatic demographic shift. Enthusiasts now in their peak earning years or those beginning to retire are not the same folks who were most active in the hobby 25 or 30 years ago.

The influx of younger buyers has, no surprise, supercharged the market for newer vehicles. Muscle cars (those of the 1960s and early 1970s) are also doing well, owing to their broad cross-generational appeal. At the other end of the market, the top five most expensive vehicles sold at auction in 2020 were prewar Bugattis. These remain valuable because, well, they’re Bugattis—exceedingly rare examples of ingenious design and engineering that appeal to well-heeled buyers of all ages.

But what about 1950s American cars—the tri-five Chevys, baby bird Thunderbirds, live-axle Vettes, and other vehicles of the immediate postwar era that for many, embody the word “classic”? You might assume that younger enthusiasts wouldn’t be major players in the market for these cars.

Right now, you’d be correct.

Millennials and Gen-Xers, who these days represent the fast-growing majority of people calling Hagerty for insurance quotes on classic cars, represent less than a third of the interest in 1950s classics. If younger collectors are clearly driving prices up in parts of the market, is the relative lack thereof in the 1950s classics market having the opposite effect?

Marketplace

Buy and sell classics with confidence

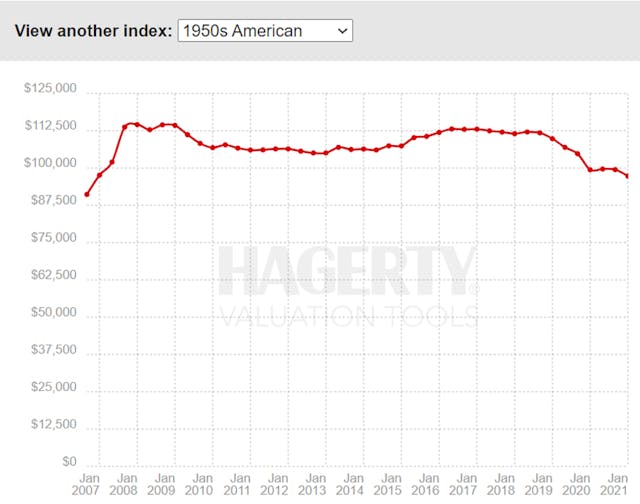

This simplest answer comes from our index that covers 1950s American cars. Comprised of 25 of the most collectible American vehicles of the era, it hasn’t moved much since its inception in 2006. Since rebounding between 2016 and 2018, it has gradually declined since. But that resource does not tell the full story.

The index is based on Hagerty Price Guide values, which is a helpful way to understand the market, but it is not the only way. To take a closer look at what’s happening in this segment, we’ve constructed a repeat sales index containing 2300 transactions. We’ve talked about these before, but here’s a quick refresher: Repeat sales indices track specific models for which there are two or more transactions (matched by the make and VIN), providing an “apples-to-apples” glimpse of the market over time. We recently used one of these to illustrate how the market for modern collectibles is calmer than high-dollar auctions might indicate.

With 1950s American cars, it’s quite the opposite: A market that appears frozen based on price guide values is, according to the repeat sales index, vibrant and changing. And the repeat sales index has held up at a higher level than either the average sale price (which includes cars that have sold at auction just once) or our price guide values.

Note the index excludes vehicles that were modified—restomods are hot right now but are in many ways a segment unto themselves. Some vehicles, however, may have been restored (partially or completely) between sales.

Zooming in on individual cars, we see some of the big jumps we’ve become accustomed to associating with cars built in the 1980s and ’90s. For instance, one pair of sales with a recent transaction is a 1957 Chevrolet Nomad that sold for $84,700 in 2017 and then sold again for $187,000 in March of 2021. Not all flips turn out so well: A 1957 Chevrolet Corvette 283 Fuelie sold for $258,500 in 2007, but then brought just $137,500 last month.

Of course, most cars fall somewhere between the extremes. The average annual return on a 1950s classic, per the repeat sales behind the index, is 3.3 percent. Hardly a depreciating asset.

Mind you, we’re not saying our price guide is wrong about overall declining values of ’50s cars. Rather, we’re saying that it is pointing out something different. The price guide index uses some of the most desirable (and valuable) American cars from the 1950s. The median condition #2 (Excellent) value of its vehicle components was $102,000 in January 2021. The sales that underlie the repeat sale index and have occurred since the beginning of 2020 have a median value of just $73,862.

This price difference has implications for who is shopping for cars in this segment, because younger enthusiasts are more price sensitive. In fact, insurance quote data from the last year shows that Gen-Xers and millennials are shopping these cars at a higher rate than before. Overall, insurance quotes for 1950s American classics increased 15 percent from 2019 to 2020, outpacing growth in the rest of the market. Not bad for a supposedly stagnant segment.

Indeed, flat or even slightly falling values of all 1950s cars should not be conflated with a definitive decline in interest. Today, insurance quote values for 1950s American classics tend to be some 20 percent more than the average for the market. If prices trend downward as older collectors leave the market, it’s likely that younger collectors will snatch them up and start the cycle over again.

This story originally appeared on Hagerty Insider. For a dose of collector car market analysis delivered to your inbox every Sunday, sign up for the Insider newsletter.