Media | Articles

Monterey auctions rake in $343M—37 percent higher than 2019

The Monterey auctions concluded Saturday with a preliminary sales total of $343M over three days—37 percent higher than 2019—despite offering nearly a quarter fewer cars. Credit a much better sell-through rate (80 percent compared to 59 percent) and higher average price ($428,004 versus $334,114). The secret, as in Arizona and Amelia Island, was better cars.

Just as in 2019, the star of the show was a McLaren F1. A low-miles 1995 F1 brought $20,465,000 on Friday, besting the $19,805,000 for an F1 LM-Spec example in 2019. This year, however, the F1 had more company. In all, 82 cars sold for more than a million dollars, versus 45 in 2019.

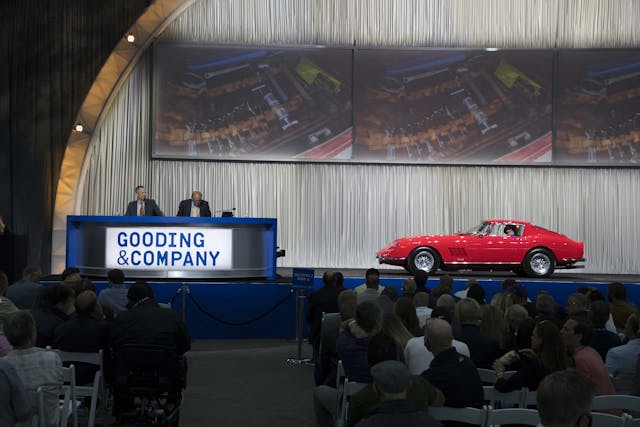

Indeed, Monterey was a strong showing for a segment of collector car auctions that had slowed before the pandemic. In recent years, sellers of top-dollar cars had grown reticent to bring their best to a public sale, fearing low-ball bidding might damage perceived value. Be it confidence in the collector car market and the broader economy or simply a desire to get out and have fun at auctions again, those sellers showed up in spades this year. Bidders responded in kind. A 1959 Ferrari 250 GTO California Long Wheelbase brought $10.84M at Gooding & Co., and a 1928 Mercedes-Benz 26/120/180 S-Type Supercharged Sports Tourer sold at Bonhams for $5.395M.

Fresh metal wins the day

Not every high-profile car found a new home. Gooding’s 1966 Ford GT40 went unsold, as did RM Sotheby’s 1955 Jaguar D-Type. The reported high bids on both were close to condition-appropriate values in the Hagerty Price Guide. Most notably, RM’s 1970 Porsche 917K, which had been poised to set an auction record for the marque, went unsold on a reported high bid of $15M.

We continue to see evidence that while $1M+ cars are selling more often than in past years, those that are fresh to market do well while those that have recently been to another auction often didn’t sell. For example, after selling in 2015 for $2.2M, a 1956 Maserati A6G/54 by Frua was a no-sale at Gooding. While its patinated exterior is unchanged from its 2015 sale, the car is now road ready and completed the California Mille earlier this year. That wasn’t enough for it to find a new home. It contrasts with a 1929 Bugatti Type 35B that Gooding & Company sold for $5.615M. That car boasts an extensive period race history and has been owned by only a couple of long-term owners—all of which was enough to set a record price for the Type 35. In a time when there are more buying opportunities than ever, along with more information about vehicles than ever, it seems jaded bidders are willing to chase only the vehicles they haven’t seen before. The year’s biggest earners, including the McLaren, had not been publicly offered for sale in many years.

Marketplace

Buy and sell classics with confidence

Japan makes its mark

That said, the kinds of cars Monterey bidders were interested in has broadened beyond the stereotypical Ferraris, Porsches, and Duesenbergs. Japanese vehicles, long seen as better suited to online auction venues such as Bring a Trailer, blasted past previous records as seasoned bidders see the long-term value in these vehicles. A 2012 Lexus LFA Nürburgring, quickly becoming one of our best Bull Market picks, rung the bell at $1.6M, a new record for a Japanese road car at auction and 72 percent over our condition #1 value. Gooding & Company sold a 1986 Toyota Land Cruiser FJ62, a car that rose strongly and set records in the online auction world, for $134,400 all in, besting the previous record by nearly $50K. Surpassing all expectations, a 1995 Nissan R33 Skyline GT-R sold for nearly twice the auction high estimate and 91 percent above its condition-appropriate value.

Analog appeal

Several analog supercars, meanwhile, joined the F1 in bringing big bids this year. A 1994 Bugatti EB110 SS sold for $2,755,000, setting a record for the model. Three Ferrari F40s sold with final prices averaging 35 percent above Hagerty #1 condition value. RM Sotheby’s sold five late-model, manual-shift Ferraris in a row—a 2007 F430 Spider, a 2001 550 Barchetta, a 2005 Superamerica, a 2005 612 Scaglietti, and a 2009 599 GTB. We know that the third pedal can add a huge premium to modern Ferraris, but these cars still surprised, with all but the 612 Scaglietti exceeding their high estimates. The 599 GTB inspired a heated bidding war, with the final price coming in at $709,000. The 2005-2006 Ford GTs are hot, too, with all eight offered selling at an average of 30 percent above condition-appropriate value after accounting for options.

Era of exotics

The supercars of the 1990s and early 2000s represent a sweet spot between the achingly beautiful but difficult-to-live with classics of the 1960s and the blisteringly fast but somewhat robotic hypercars being built today. These vehicles are poised to climb even higher as younger enthusiasts who grew up with them get deeper pockets.

Return to form

Overall, the three days of spectacular sales in Monterey confirmed what we knew going in: The collector car market has weathered the pandemic and then some. We forecast 2021 will be the best year ever for auctions, largely thanks to the growth of online platforms. Monterey also provided a reminder that live auctions, and the electrifying atmosphere surrounding them, continue to serve an important role, especially as a venue for exceptional, top-dollar cars.