The latest Hagerty Price Guide update had value gains far and wide

Earlier this year we announced that the Hagerty Price Guide would be updated on a quarterly, rather than triannual basis so we could report on the state of the market in a more timely manner. Turns out that decision couldn’t have been more, well, timely. The gains in the market, which we’d been observing throughout 2021, only accelerated in early 2022. In particular, the auctions in Kissimmee, Florida, and Scottsdale, Arizona, gave us a number of market-adjusting sales to consider, and The Amelia sales in March added to the pile.

To be clear, while discussions tend to gravitate to the subject of auctions, they still make up a small portion of all vehicles bought and sold in the collector market. Yet because auctions report sale prices, they do offer an insight into where the market is heading. For each price guide update we also observe listings from private sellers and dealers, sift through insurance data, and seek input from marque experts. Altogether, they give us a complete picture. What we see this quarter is a market that is changing very fast, and likely will continue to do so. In particular, we saw movement in the following segments:

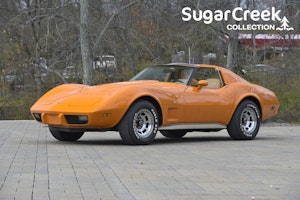

Muscle cars have never been this hot

Muscle cars being "back" really isn't news by now (and to be honest, they never really left, even if values were on a plateau). This January was something altogether different—the market for muscle went completely anabolic. Previous books saw large movements in the upper echelons of the muscle car market, but this volume saw a huge activity for higher volume models.

Notable movers include LS5-equipped 1970 Chevelles, which rose by 42 percent, 1969 Camaro Z/28s, which rose by 38 percent as well as 390 and 428 powered Mercury Cougars, which rose in value anywhere from 20–40 percent, to name a few. While these cars still remain above the norm with their gains, a large portion of the muscle car segment still rose on average 5–10 percent, which is no small thing given the wide range and variety of cars that make up this market.

More German cars gain ground

As in the muscle car segment, gains that had been concentrated on certain top-tier German machines have become more widespread. In particular, while Porsche still appears to be the clear winner, you can't ignore big gainers from BMW and Audi as well.

Marketplace

Buy and sell classics with confidence

The 997-series GT2 RS and GT3 RS which posted gains in the range of 30-40 percent. BMW E31 (1990-97) 8-series. While the 850 posted modest gains, the 8-cylinder powered 840Ci posted an average gain of 44 percent to catch up with their 12-cylinder siblings. Finally, V-10 equipped Audi R8s surged ahead an average of 20 percent, while the more affordable 1994–97 Audi S6 and 1997–02 S4 gained approximately 11 percent.

Older Japanese cars on the move again

A great deal of attention is paid to Japanese sports cars from the late-'80s on. Indeed, that is where a large portion of the market activity lies; however, examples from the '60s and '70s are on the move again after a long period of little change.

Here is where our focus returns to the venerable 240Z. It is a car that we have discussed at length on multiple occasions, but here we are again. While gains have slackened a bit over the months, it still posted some of the largest increases in this update at an average of 12 percent. Hot on its heels was the 260Z, posting similar gains. Surprisingly, the rather affordable Datsun 510 posted a gain of 5 percent on average. While this does not equate to much dollar wise, this often-ignored model could be seeing some renewed interest.

Another update for the record books

Normally, we'd talk about a few losers. Yet in this update—as with the last one—there were hardly any. Even if not specifically mentioned, there was a good chance your vehicle gained in value, even if just by a bit. With the exception of the Hummer H1 which lost approximately 16 percent, most downward adjustments were relegated to small groups of cars rather than a broad reductions. In a market such as this, we expect few cars to lose value in the short term and many to post gains until the market peaks. How soon that might happen is anyone's guess.

(The latest Hagerty Price Guide is live at Hagerty.com/valuation-tools)

I thought there was going to be a video about the price guide on 04/25/23. Where the hell is it? You guys need to hire a content curator!