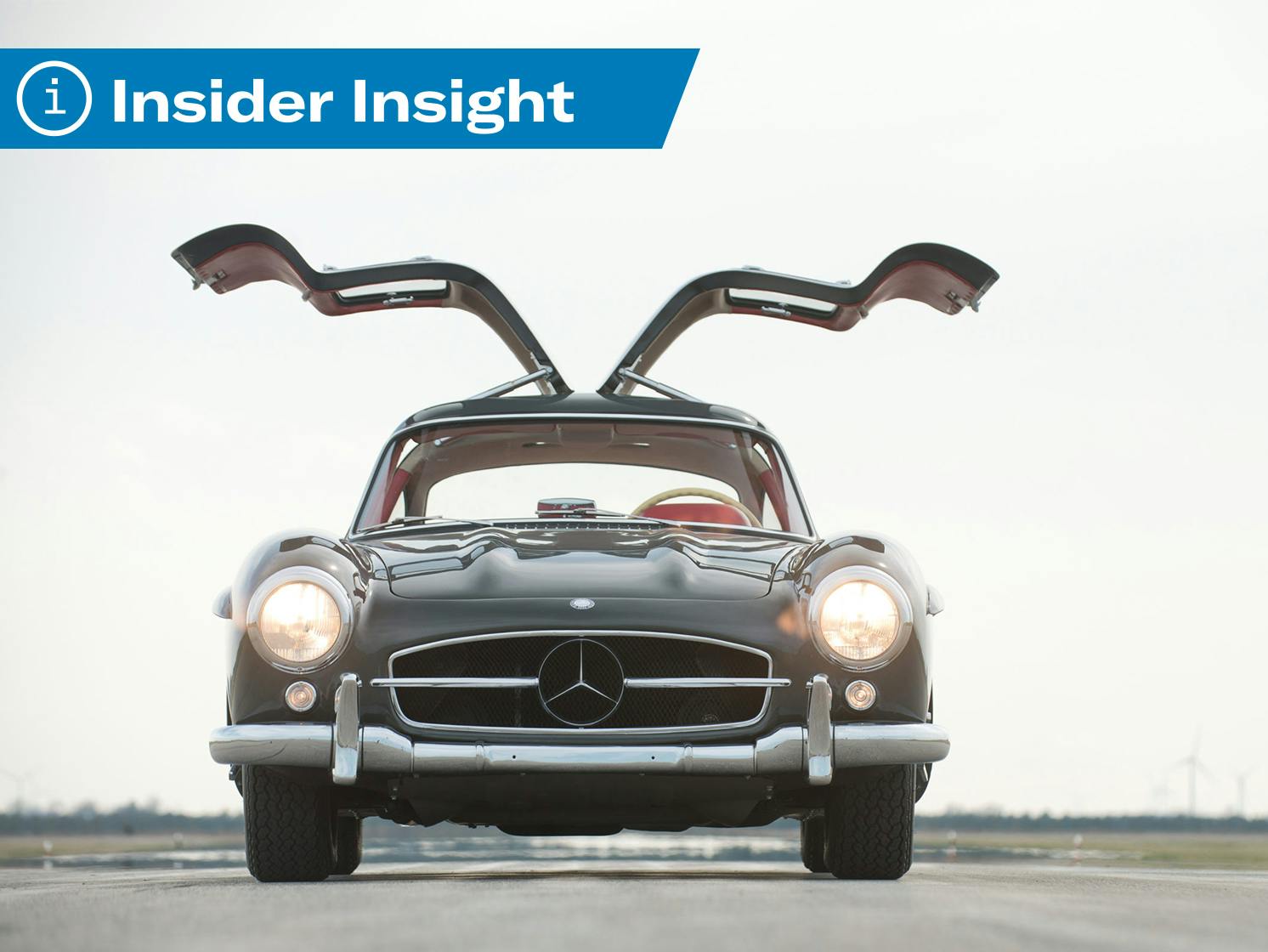

Why the Mercedes-Benz SL helps us watch the entire collector car market

With the reveal of the latest Mercedes-AMG SL this week, the car internet is awash in nostalgia for the beauty that started it all, the 300SL. And why not? Its performance and style made it the vehicle of choice for the rich and famous in the mid-1950s, with famous owners ranging from Juan Manuel Fangio to Zsa Zsa Gabor and Juan Perón. It was also a capable race car—John Fitch drove it to a class win in the 1955 Mille Miglia. The 300SL retains exceptionally wide appeal today among both car enthusiasts and the broader population. Like Clark Gable or Sophia Loren (both 300SL owners at one time), the Merc has timeless sex appeal.

Over at Insider, we love the 300SL for yet another reason: It makes a helluva repeat-sales index.

A car that sells once for a wild price might indicate a market shift. Or maybe it’s an outlier. But if it sells again, then we have a consistent comparison. We call these repeat sales, and we dig them. So much, in fact, that we’ve built a number of indexes consisting of thousands of repeat sales to track various vehicle segments. Our favorite follows 300SLs.

What makes 300SLs special, even among classic cars, is they have been valuable since new. With all due respect to six-figure JDM coupes and even the most coveted muscle cars, only a select few vehicles have consistently been desired by the jet set over decades, and the 300SL is foremost among them—the bluest of blue chips. More things in the 300SL’s data-tracking favor: These cars sell relatively often, have unique serial numbers, and—excluding 29 aluminum-bodied coupes—did not vary greatly over their build run. As a result, we’re able to track repeat sales of hundreds of SLs going back decades and, in so doing, get an apples-to-apples glimpse at the collector car market over the long run.

An index such as this has two important purposes. The first is to study the history of a given market. That’s particularly important for collector cars, which are, generally speaking, quite young as an “asset class” as compared to, say, gold or art. Looking back over more than 20 years in 300SL index, we see that it, no surprise, has its peaks and dips—which correspond roughly to periods of boom and bust in the larger economy—but that these shifts are less dramatic than one might think when tracking a noisier stat, like average price. (Average price would include “new-to-market” SLs, such as barn finds and cars that have been in one collection for decades.)

Just as important, the index can operate as an indicator for the future. That’s particularly important at times when the market seems to be changing very quickly—like now. We see that SL values are, indeed, climbing like everything else, but not as sharply as headline-making Bring a Trailer sales or even our Hagerty Price Guide might suggest.