The state of the market according to PCarMarket

Before we begin, some ancient history: In the year 2019, one of the challenges facing the collector car market was sellers expecting too much money for their cars. Their unwillingness to budge from said expectations led to a bunch of no-sales at auction—most notably Pebble Beach—and had many industry watchers (including us) suggesting sellers needed to reset their expectations. Then COVID happened. Its far-reaching fallout, which included millions of people stuck at home with trillions in stimulus money, turned supply-and-demand on its head and lit a fire under classic car prices that are still burning hot. Yet listen to Jim Barry, senior vice president at the popular online auction platform PCarMarket, and it sounds like we might gradually be returning to 2019.

“Right now, we have a lot of sellers getting respectable offers, but the cars just aren’t moving, because [sellers] are so far ahead of the actual market,” he said.

We’re data-driven folks over here at Insider, but there’s only so much you can glean from the harsh glow of a spreadsheet, which is why we also talk to people. Industry sentiment factors into many of our metrics, including the Hagerty Price Guide and the Hagerty Market Rating. Of late, we’ve been hearing some words of caution creep into our conversations, even if the overall take is still that business is good.

Indeed, Barry emphasizes that things have been very good for PCarMarket. As the name suggests, Porsches of all shapes, sizes, and ages fill the bulk of PCarMarket’s runlist, but nowadays a healthy assortment of Autobahn bruisers, late-model exotics, American muscle, and even the occasional EV supertruck can be found between the platoons of 997s and Boxsters. Practically all of it selling for prices that would have stunned Barry (and us) not long ago. “We’re doing really well with AMG Mercedes, even later models that used to be hard to sell,” Barry said. “I’m talking about stuff like a 2018 SL63, a car that was tough to sell even at auction in general. Now, that stuff is flying off the shelf and gone up in value. I think we sold three of them in the past week.”

Yet when we spoke earlier in May, one of Barry’s main talking points was sellers expectations, and how that might impact the market in the coming months.

“The sellers are getting really, really, really, crazy with their prices.”

“I think the challenge any sales platform is facing—whether that be a dealer, an auction or third party—is that the people who have the cars, don’t really want to sell them. It’s creating these obscenely high prices, and obviously there is a shortage of new cars, so some people naturally flocking to used and collector cars as an alternative.

“In other words, the sellers are getting really, really, really crazy with their prices, and it’s creating an environment contrary to the one we saw a few months ago, where we saw everyone selling.”

“It’s greed coupled with lack of knowledge. Dealers have cars out there for obscenely high asking prices; whether they get them or not, no one knows. [Collector car] Dealers are just buying up everything, and they are a big part of the reason the prices are so high, as they’re trying to horde all the inventory. But, you can’t blame them for that, as there’s nothing else you can do. People walk into your showroom and see nothing, they’re walking out and never coming back.”

“Case in point: we had a GT3 Touring where $350,000 wasn’t enough for the seller, and I think the sticker was like $215,000 or something like that. He based his ask on the fact that dealers are asking $400,000 in some circumstances, if one comes up. Are they getting that? I don’t know. But, to get $140,000 over sticker is nothing to sneeze at.”

“The cycle begins anew”

“Other than the baseline state of the economy, I think what’s driving the current Porsche spike is simply supply and demand. You have a car you don’t want to sell, but as prices continue to rise up and up and up, you’re eventually forced to sell. Let’s say I have a 993 in my garage I bought for $35,000 back in 2012, and I discover that it’s now worth $120,000; maybe I don’t want to sell, but I have to. So, as people begin to unload things, the prices come down, and the cycle begins anew.”

A correction could be coming for the flotsam

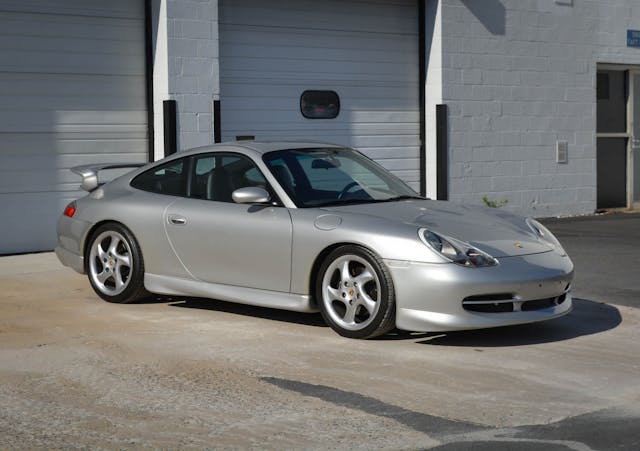

“Blue chip cars are blue chip cars, so they’re always going to be something. But, the stuff that always rises with the tide, like the 997 Cab with PDK dragging 90,000 miles and a bad Carfax that should be worth $35,000 is getting $55,000 because the market is crazy right now? Yeah, I believe there will be a big correction on stuff like that.”

But 996s may still be too cheap

“I was a kid in college when the 996 came out. People say these cars are ugly, and undesirable, right? I was a subcontracted detailer at Manhattan Motorcars when the 996 was new, and I watched people come in and pay almost $200,000—the sticker was around $125,000—they’d pay up to $80,000 premiums, and if the car was so ugly, and so bad, why were people doing that?”

“I’ve never not liked the 996, and I still think they are too cheap. Considering what you must spend to land in a new 911, and you can get a car like it for $30,000? $40,000? It’s still way too cheap. Hey, I remember when 964s were like that—I was a dealer for a long time before this, and people would offer me 964s all day for $15,000, $20,000. Now, they’re a fortune.”

“If it’s not the top, then we’re not too far away from it”

“A lot of the guys are just looking at these things as a hybrid situation. They want the car, but they do think about what their exit looks like, and I believe a decent amount of buyers and enthusiasts think along those lines.”

“There are a lot of people that just go out and buy what their agent tells them to based on future value, and that’s just not going to change. But, I think a lot of people are getting out right now, because if it’s not the top, then we’re not that far away from it.”

***

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.