Scoring our 2022 collector-car market predictions

At Insider, Hagerty’s website that covers the collector-vehicle market, we have only recently started publishing annual market predictions. We pore over a lot of data over the course of any given day, and we’re proud of our ability to spot trends (our Bull Market List cohorts have performed particularly well).

That said, our 2021 predictions score was just 2.5/6. How’d we do with our five predictions for 2022? Keep reading to find out.

This time last year, we were concerned about the lingering effects of the pandemic, which would appear as continued disruptions to supply chains and further growth of online auctions. Unrelated to the pandemic, we expected the market to continue its demographic changes.

All told, here are the predictions and scores:

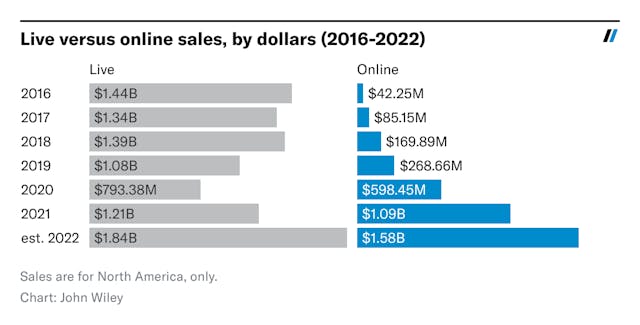

Prediction 1: Sales at online auctions will double (again)

Not even close. We expected total sales at online auctions to exceed $2 billion through a combination of additional growth and higher values. While sales have doubled in most years since 2016, this year, online sales will likely only increase by 45 percent to $1.58 billion. Growth in the number of vehicles sold slowed by more than half (from 70 to 30 percent), and appreciation for many of those vehicles has also slowed.

Prediction 2: SUVs and analog supercars will continue to appreciate, but older American and British cars will tread water

Three-quarters right. Here is where we get into demographic shifts, as Gen-X enthusiasts (1965-1981) tend to be especially interested in SUVs and supercars, while older generations often like American and British production cars from the 1950s.

SUVs increased by 9 percent from January 2022 through January 2023. Analog supercars increased by 23 percent over the same period. Conversely, 1950s American cars (excluding Tri-Five Chevys) increased by 6 percent, and same-era production British sports cars fell by 3 percent.

Prediction 3: We’ll see the return of eight-figure classics

Correct! We saw the first nine-figure sale with the $142 million 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupe. All told, five cars sold for more than eight figures, which is up from just two in 2021.

Prediction 4: A Japanese car will sell for more than $2 million

Correct! We assumed it might be a Toyota 2000GT convertible from one of the 007 movies or perhaps a Mazda or Toyota with Le Mans history, but it was another combination of those features. Instead, a 1967 Toyota 2000GT with Shelby racing history (shown at top of article) sold for $2.535 million at the Gooding & Company’s Amelia auction in March.

On the private market, some cars have sold for close to $2 million, so we’ll likely see more sales like this in 2023.

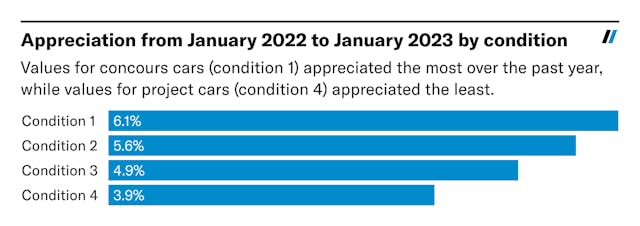

Prediction 5: Project cars will stay shelved

Correct! The logic behind this prediction was that parts were harder to get, and people wanted to drive sooner rather than later. While quantifying this isn’t straightforward, if we saw more appreciation for condition 4 vehicles than other, better-condition vehicles, the demand for projects would be greater. If the condition 4 value appreciation lagged the better-condition vehicle values, those projects would have stayed shelved. What happened? The average condition 4 value increased less than 3.9 percent, which lagged all other condition values – with increases of 6.1, 5.6, and 4.9 percent for conditions 1-3, respectively.

At 3.75 out of 5, or 75 percent, we outperformed our lackluster 42 percent showing from 2021. We’ll take it, especially considering what a topsy-turvy year 2022 was.

Stay tuned for our 2023 predictions, and don’t forget to share your own in the comments.

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it.

None of this was all that difficult to assume.