January’s Live Collector-Car Auctions in Four Charts

From the Hagerty Insider live blog to detailed auction reports, we’ve sliced and diced the big sales from January in several different ways. After weeks of poring over data, however, a few chartable themes emerged. Here are a few final takeaways as the first chapter of 2024’s auction season draws to a close.

Online sales have grown, but traditional auctions still own January

Online auctions may have established a healthy steady-stream business model, but they can’t compete with the energy and entertainment factor of live auctions. The events in Kissimmee and Arizona bring car enthusiasts together to enjoy a destination, and that’s helped drive healthy sales figures and revenue beyond what’s generated when the cars cross the block. That event atmosphere concept has been around for some time, but was solidified in 2022, when a majority stake of Barrett-Jackson was bought by IMG, a company that operates hundreds of live sports and entertainment events globally. Even if the collector market is weaker, January’s live sales still posted some strong numbers, and the event atmosphere certainly helped that. At the same time, online auctions have now come close to saturation levels.

Pandemic premiums have receded

Over the repeat sales of three cars, the most recent of which happened this past January, we can trace the market’s trajectory. The face-palm-inducing prices from two years ago are gone, and that’s true across price points and segments. If you have thrown your arms up in defeat and said, “I’m priced out of the hobby,” then these times might perk you up again. We see from these repeat sales there is always money to be made and lost, but this year there was a far more even return. The spread is wide, but the median percentage return in price on a collector car bought within the last four years and auctioned in January evened out to zero percent. The deals are back out there.

Custom cars are driving Arizona auction totals

Arizona, and Barrett-Jackson in particular, has positioned itself as the place to sell customized vehicles. Barrett-Jackson was always a destination for restomod rides of all stripes, but it’s only gotten stronger over time. Interestingly, though Mecum is widely considered a haven for muscle cars, and muscle cars are a popular choice for restomods, their Kissimmee auction shows a shrinking percentage of customized vehicles. Chalk this up to two factors: Arizona’s strong reputation for this sort of car, and Mecum’s expansion into a wider array of segments combined with their ever-increasing car count.

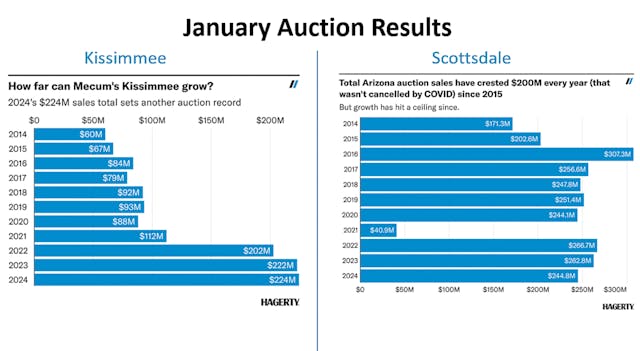

Totals were down but not out

A slowing market may have impacted the January auctions, but you might not know it by looking at the overall sales numbers. Mecum Kissimmee posted $224M in sales, besting last year’s effort by a nose and continuing that auction’s streak of $200+M in sales. Arizona fared slightly better with its $244M final number, though that was spread out over five auction houses. Three or four more top-tier cars (offerings were down significantly from last year), and Arizona’s result may well have been in line with those from 2022 and ’23.

Time will tell whether Mecum’s solo sale in Florida will eclipse the multi-house event in Arizona. The trend suggests that might well happen, but between the softening market and the success these companies have found in making a destination out of live auctions, it’s tough to be sure how that will unfold. And that’s part of the excitement of watching January’s big shows.

***

Want a better understanding of what’s driving collector car values? Sign up for the Hagerty Insider newsletter.

The totals are still impressive, especially compared to 10 years ago. It can’t be up every year, it has to go down sometime. Right now is the most logical. Will be curious if the market changes in 2025.