How a Hagerty data analyst shops for cars

Data drives my writing here at Hagerty Insider. Whether I’m analyzing the latest bidding trends in this increasingly-white-hot market or a diving into which MOPAR color is most valuable, I use objective data points as my guide. That can strike some enthusiasts as odd: after all, classic car collecting is inherently an emotional pursuit. I get that. Like the rest of you, I came to Hagerty because I love cars. Yet even in my personal car hunting, I incorporate data into my decision making. You can, too.

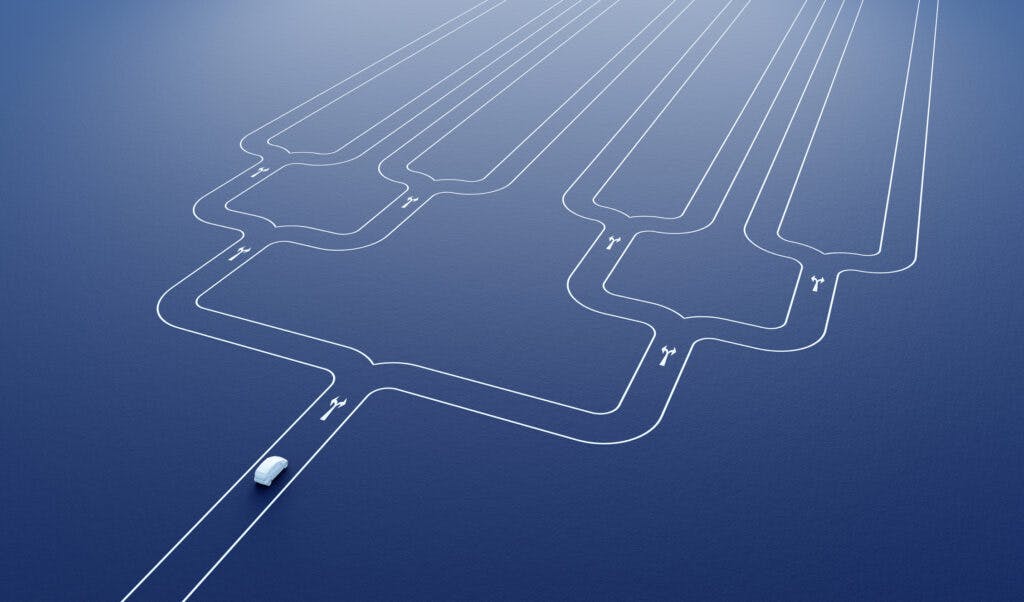

When setting out to buy a vehicle, I suggest using a decision tree to underscore your priorities. A set of metrics can define and refine your automotive objectives, matching you with the perfect car for your needs and desires.

A decision tree is like a road with a bunch of forks. You go left or right when you get to a fork depending on how you answer the question. Sometimes questions are financially driven, while others help nail down specific attributes (ie: how important is it for you to be able to put the roof down?). The tree is equally helpful in putting a finer point on the exact car you want within a given model or helping you narrow down your search from a broader category. I’ll often overlay a score for each decision fork to assign an even more exact evaluation at each step. Below are just a few “forks” I have used—you can construct yours to prioritize as your search requires.

Cost:

Cost is the optimal starting point because of its impact on subsequent decisions. I haven’t spent more than $30K on a car in the past few years, but haven’t I spent less than $10K, either. The cars have all been running and driving, leaving room to catch up on deferred maintenance. Secondary cost considerations include shipping and transaction fees.

Complexity:

If many of us will soon be driving around in EVs with orders of magnitude fewer moving parts and autonomous features, why not seek out something with an unusual drivetrain and more driving engagement? Perhaps something that advanced the state-of-the-art when it was introduced? Plenty of factors could come into play here: cylinder count, engine configuration, transmission gear count, even the amount of independently sprung wheels.

Of course, a different collector—say one with less time/money for making repairs–might prioritize simplicity. There’s no wrong choice at many of these forks, but there might be one that’s better for you.

Rarity:

We’ve all seen ads for “One of ten built on a Monday in August with the base engine, automatic transmission, and unpopular color. I know what I have.” There’s a right kind of rarity that helps value and collectability—typically the vehicle didn’t sell well when new because it was too focused and expensive, and the new car buying public didn’t bite. Think McLaren F1, Lexus LFA, BMW E30 M3. “End of the line” models where the maker didn’t directly replace it are often even more collectible. Aside from value, riding around in a car that no one sees every day is part of the appeal. Lower production is generally better, but keep in mind the parts trade-off: The rarer the car, the more it’s likely replacement parts will be costly and hard to find.

Use:

How am I going to use this new ride? Will it overlap with other vehicles I already have? The more it provides a unique experience relative to my other cars, or promises to be used frequently, the better it will fare in my analysis. For instance, up here in the Pacific Northwest, the days when I can take a convertible out are more limited than, say, Los Angeles. That said, I value every top-down chance I get, so having a convertible was a big priority for me.

Events and Clubs:

This takes your use case a step further. Are you planning on tracking your new companion? Meeting up on weekends with fellow enthusiasts or heading to events like Radwood? Factors like rarity and consumables related to the events (like brake pads components and tires for track use) take on additional meaning here.

Design:

By far the most subjective fork—attractive design means different things to each of us. Take a moment to list what speaks to you most about each of your options.

Story:

What’s the story behind each of your potential purchases? What kind of documentation do they have? If the car is unrestored but has a great story and documentation, the car will be more valuable. If it’s had a handful of owners but is thoroughly updated to be your perfect track weapon, it may be worth less on the market but more to you if that’s your goal.

Theme:

Be it brand, nation, era, drivetrain, or anything else, most of us have a given theme to our accumulation of cars. Perhaps yours is variety: you already have a front-engine, rear-drive chassis and you’d like to add a mid-engine vehicle to the mix. Whatever the case, identify your preference for this purchase and where each option slots in.

Time:

Finding a car with the ideal combination of the above factors can be a time-consuming process, but the chase is part of the fun. This process can take patience. Do you want or need to get out and drive right now, or can you afford to wait for the perfect car? This can also help you decide what condition you’re looking for. Do you have the hours to fill with a project? Or do you need something that will be ready to roll the one Sunday a month when you have time for a spirited drive?

Order:

Consider these forks (and the ones you come up with) in your order of importance. For some, design will take precedence over use. Others may prioritize rarity. Remember: how you set up your decision tree is up to you—there is no single right way for everyone to go about this process. Keep in mind that this isn’t a tool optimized for outsized risk-adjusted returns. Rather, the factors I’ve suggested above are designed to help return a compelling car that meets the metrics you create for yourself.

Case study:

A few years ago, I needed a new daily driver. Here’s the approach I took.

I wanted a sports sedan in the $10K to $30K range. I put my tree into action.

First, complexity. These days, many options in this category have a turbo 4-cylinder engine, which rates low on my drivetrain complexity scale, but some have all-wheel drive and transmissions with 8-speeds (or more), which I regarded as positives.

My preference for rarity steered me away from segment leaders like the BMW 3-Series and the Tesla Model 3, which sell in huge numbers, and toward lower-production competitors like the Cadillac ATS, Jaguar XE, and Alfa Romeo Giulia.

For use, I knew this would be a daily driver. That guided me toward nearly new cars. An E36 BMW 3-series might be nice, but why punish it with daily commutes?

I set aside the events branch of the decision tree, as it’s unnecessary for a daily driver. Where I live, there are numerous active clubs (often more active than I have time for), so this wasn’t a limitation either.

From a design perspective, I gravitated to Alfa Romeo Giulia’s great-from-any-angle take on a sports sedan over the Jaguar XE, which was attractive but not as complete of a visual package for me.

Having worked my way through the tree, I looked long and wide for a slightly used Alfa Romeo Giulia and settled on a one-owner, clean CarFax Q4 (AWD), Ti (better equipped), with the rare performance pack (LSD and the bumpy road setting). I found one online a couple of states away at a dealer, did the paperwork, and it arrived a couple of weeks later. The Alfa also fit with my convertible because they’re both Italian. Two years later, I still enjoy driving it whenever I get behind the wheel. And although I’d never try to quantify that nirvana on one of my spreadsheets, I do think my data-informed decision making helped me reach it.