Ferrari F40s went bonkers in Monterey this year

The Monterey auctions have always been an important window into the health of the high-end collector car market. In 2019, as the upper end of the market settled, Monterey confirmed it with a soft $250M result and a 59-percent sell-through rate.

COVID-19 made Monterey 2020 a non-starter, and now, in a world adjusted for pandemic life, with a market that has roared back to health, the 2021 Monterey numbers certainly did not disappoint. How? With $351M in total sales from roughly 25 percent fewer cars than in 2019, and an 80-percent sell-through rate. This despite the Delta variant keeping most of the rest of the world away from the foggy peninsula for Car Week.

Still, at every auction I attended, there was a level of excitement among bidders, consignors, and observers that just wasn’t there even in 2019. As always, a few results caught my eye for various reasons.

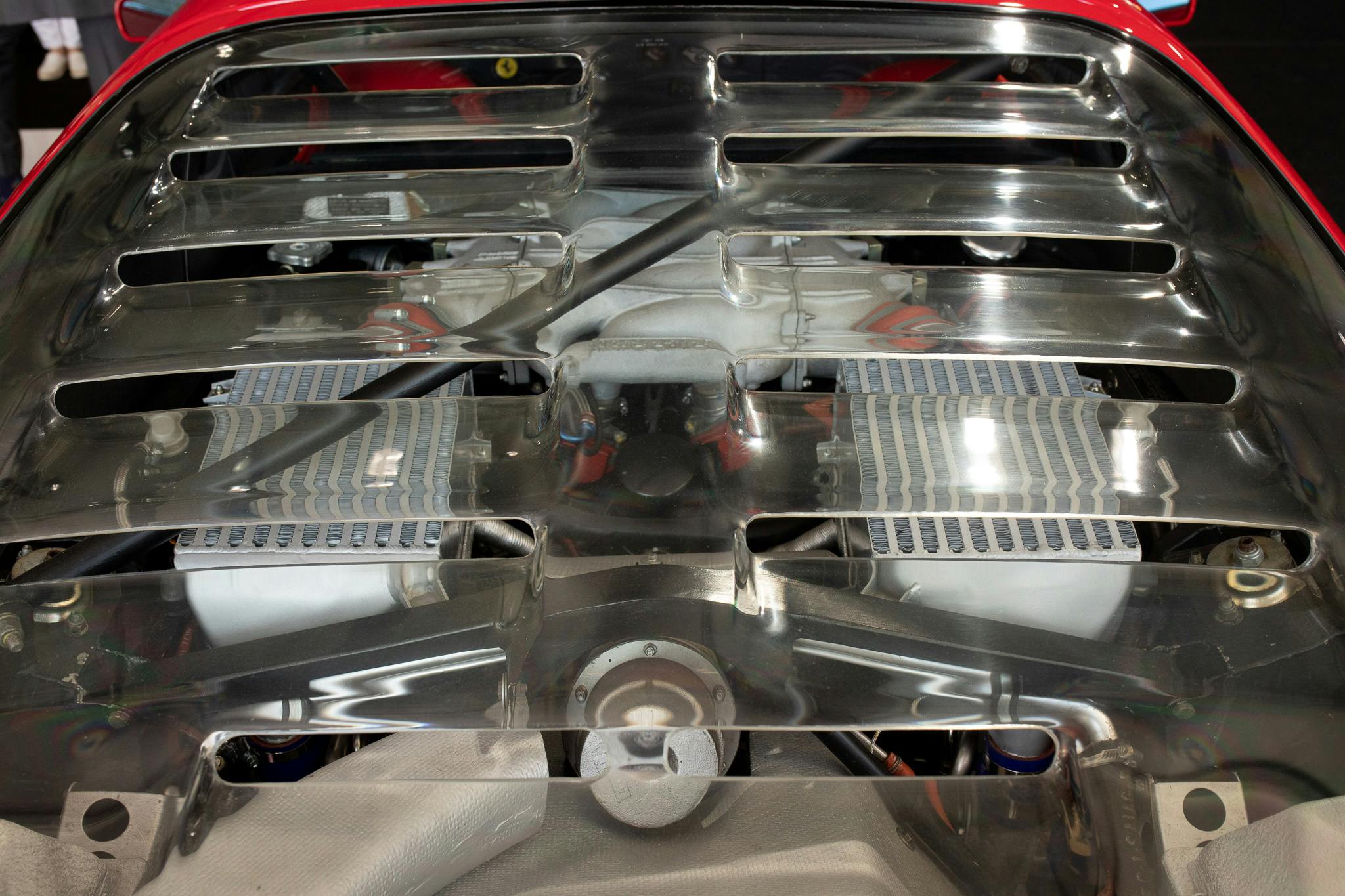

I’ve been tracking the Ferrari F40 market for the past few years. Prior to 2021, the highest priced U.S.-spec F40 sold at auction was a 1700-mile car at RM Sotheby’s Monterey in 2018, for $1,710,000. Around that time, higher-mileage examples and Euro-spec cars were just to either side of a million. But this year’s F40 results from Monterey look to have reset that market, with three of the supercars sold at auctions.

First, a 2500-mile 1992 F40 sold at Gooding & Company for $2,892,000, followed by a 2,800-mile car from 1991 that sold for $2,425,000 at RM the next day—an F40 which RM previously sold at its 2017 Monterey auction for $1,540,000.

Low-mileage and great condition were key, because Bonhams "only" managed to snag $1.6M from a slightly edgy 1992 F40 it sold with 16,000 miles on the clock. Taking into account the roughly $1.1M knock for the extra 13,000-plus miles, it appears that every extra digit on an F40 odometer costs about $80.

Seven-figure exotics aside, Monterey remains an exceptional place to sell exceptional cars, regardless of price point. Take the 1973 Porsche 914 that sold at Mecum. A stunning, unrestored one-owner car in Olympic Blue with 13,900 miles, it was offered with a stack of great original paperwork and was virtually showroom new. Despite having the 1.7-liter engine—least desirable of 914 mills—the spectacular condition and great color clearly hit home with the bidders, and it sold for $80,500, well over double the last record price for a 1.7-liter 914. That isn’t exactly pocket change, but within the context of Monterey, someone bought an inimitable sports car for a fraction of the buyer’s premium on any of those F40s.

Finally, I was impressed by the sale of the 2004 Ford Shelby Cobra concept car known as “Daisy.” The result offers great insight into how the right seller, a great venue, and perfect timing can add up to a terrific result. The seller was Chris Theodore, former vice president of product development at Ford and, along with Carroll Shelby, an integral part of the team that created Daisy. Eighteen years ago, these two men unveiled the car on the lawn at Pebble Beach. In 2017, Ford made the rare decision to sell the one-off concept car at a charity auction to help fund the restoration of Henry and Clara Ford’s former Fair Lane estate. The buyer was none other than Chris Theodore, who paid $825,000 to bring his baby home.

Ford had rendered Daisy inoperable ahead of the sale, but Theodore got the original build team back together to make it a running, driving car again. In the process, he authored a book about the project, got Daisy a lot of screen time on various TV shows, and did a fantastic job of giving the car a new lease on life and a new level of celebrity.

Theodore consigned Daisy to Mecum, which did a marvelous job of pre-auction promotion. It paid off when the car hammered sold for $2,640,000 in Monterey. Right seller. Right place. Right time.

Given these few examples and the overall auction results, energy, and excitement witnessed in Monterey, I think it’s safe to say that for many people, the collector car market is a “happy place” and a fun, easy way to divert our attention in these challenging times. I have no doubt it will remain strong through the Scottsdale and Florida auctions in January, which will certainly offer more priceless insight and interesting sales of their own.