Lord, Fraud: The cash-strapped British noble who destroyed his Ferraris for the insurance money

Twenty-five years ago Charles Ronald George Nall-Cain, the third Baron Brocket, was beginning a five-year jail term in Springhill prison in Buckinghamshire, U.K. His crime? The destruction of three classic Ferraris and a Maserati to make a fraudulent insurance claim for £4.5 million—that’s $14M today—five years earlier.

Lord Brocket had amassed a collection of 42 rare cars including an ex-Niki Lauda Formula 1 racer and a Fangio-Moss Maserati all paid for by a hefty bank loan, willingly offered when the cars were believed to be fast-appreciating assets. His ancestral home, Brocket Hall in Hertfordshire was also turning a tidy profit as a conference venue and golf course.

That all ended very suddenly in early 1991 with the start of Desert Storm, the first Gulf War. There was a global financial shock, the conference bookings stopped, interest rates rocketed, and the market for classics dried up. Facing mounting debts with no way to pay them Lord Brocket, his wife Isa, and his mechanic Steve Gwyther hatched a daring, highly unwise plan.

The cars in the Brocket collection, stored in two converted barns with state-of-the-art security systems, were insured for considerably more than they were now worth. If just four cars happened to be stolen the insurance payout would keep Brocket Hall afloat. Act of desperation? Yes. Insurance fraud? Most certainly.

Of the four cars selected three were 1950s’ Ferraris: a 250 Europa, a 340 America Cabriolet and a 195. The last was a Birdcage Maserati.

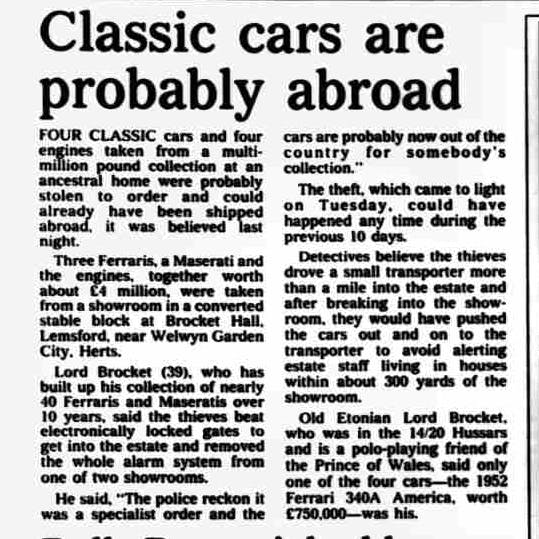

In May 1991, the cars were indeed reported stolen, making headlines across the U.K. Police first suspected that they had been taken to order, whisked away on a transporter in the dead of night after the thieves somehow disabled the alarms and left without a trace.

However, it seemed implausible that none of the staff who lived just 300 yards from the showroom heard anything at all, and soon rumors were flying around that the cars had been sunk in Brocket Hall’s lake or buried under its golf course. With no evidence to be found, the truth would not come out until 1995, when Lord Brocket’s now ex-wife spilled it after being questioned by police over a suspected forged prescription.

Gwyther had suggested crushing the cars to destroy any evidence, but Lord Brocket would have none of it. Instead he proposed that the cars should be dismantled and hidden away. If the insurance didn’t pay out the cars could be miraculously found again and rebuilt.

Over the course of three nights they took the cars apart, destroying the bodywork, but saving the mechanical components and hard to recreate parts such as instruments and badges. These were carefully boxed up while a wood-burning boiler was used to turn aluminum body panels and interior trim to ashes. The saved parts were driven to a west London storage unit.

As Lord Brocket wrote in The Times newspaper in 2005, it was with a heavy heart that this demolition took place. “As I heaved the bits into the furnace I again promised myself that these cars would, one day, be rebuilt. By then, hopefully, our problems would be over.”

In the end, the whole illegal exercise proved futile. Lord Brocket’s bank came up with a rescue package and he withdrew the insurance claim and so never received any money from the scam. That didn’t bother the police, however, who only cared that the fraud had been committed in the first place. Lord Brocket admitted everything in court and was sentenced to five years in jail in December 2005, eventually serving less than half that. Crime, as is often the case, most certainly did not pay for the English nobleman.

Fortunately this story has a happy ending, for the cars at least. They were recovered, sold and rebuilt. The Birdcage Maserati was last seen in public at the Monterey Historic Races at Laguna Seca in 2000, the 340 America has a new home in Japan after reportedly being sold for more than £1 million (now $2M), and the 250 Europa was resurrected in 2002. The 195 reportedly found its home with an American owner in 1997.

The swimming Bugatti

We can’t talk about high-end insurance fraud without mentioning Texas exotic salvage yard owner Andy House, who was famously caught on camera driving a 2006 Bugatti Veyron into the Gulf Bay lagoon in November 2009.

After first suggesting that a low-flying pelican distracted him, House then claimed that he accidentally swerved while reaching for his phone and speared off into the water. House also left the Bugatti’s eight-liter, quad-turbo W-16 engine running which meant it sucked up plenty of salt water and guaranteed that the car would be a write-off.

Philadelphia Insurance suspected something fishy and denied his $2.2 million claim, eventually settling for $600,000. After the video evidence emerged House pleaded guilty to his fraud in August 2014 and was ordered to pay back the $600,000 and sentenced to a year and a day in federal prison, followed by three years of supervised release.

On the plus side, he did go viral on YouTube.

The Goldfingered DB5

Another high-profile case that has been suspected of being fraudulent is the 1997 theft of an original Goldfinger Aston Martin DB5 from its Florida owner’s hangar at Boca Raton airport. The owner Anthony Pugliese III bought the car in 1986 for $250,000, but by the time of its disappearance it was valued at $4.2M. One evening in June that year the 007 Aston Martin was dragged from the hanger and seemingly loaded on a truck. Pugilese was investigated but no evidence of fraud was found. Rumors of the cars whereabouts range from it being somewhere in the Middle East to having being sunk in the Atlantic. Art Recovery International is still offering a six-figure reward if the car is recovered.

These are the high-profile stories that we get to hear about, but the reality is that fraud in the classic and collector world is small compared to the overall insurance industry. And as you’d expect, fraud involving rare and especially valuable cars is even more difficult to get away with, whether in North America or Europe. Former head of the London Metropolitan Police Stolen Car Squad Dr. Ken German, who now investigates fraud for auction houses and insurance companies, says that such cons do continue, although not very often.

“You only hear about the ones who get caught,” German tells Hagerty, speaking from his experience in the U.K. “From the police side it really is quite difficult, unless you have a suspicion or probably a snout who can tell you what’s happening. You have to back up any case with overwhelming evidence to get the Fraud Squad involved, and you need at least 70 percent certainty to get it past the Crown Prosecution Service.”

German believes that today most classic car crime is based around creating and selling fake vehicles rather than destroying cars for the insurance money. There are more Alfa Romeo Monzas, more Bugatti Grand Prix cars and more Jaguar D-Types than were ever made by their respective manufacturers, he says. Indeed Lord Brocket himself was found to have faked a 1962 Ferrari 250 SWB from a 250 GTE 2+2, but that’s a whole other story …