Reputation Management: Welcome to the Jungle!

Welcome to Reputation Management! In this new series, we’ll explain the oft-mystifying behavior of your local automotive industry—places like car dealers and service shops.

First, we’ll dig into publicly available customer reviews for those businesses. Then we’ll remove the names and discuss the situation from multiple viewpoints, leaning on my years of experience as a—you guessed it—reputation manager.

If we do this right, you should walk away a better, smarter consumer. Let us know what you think in the comments! —Sajeev

***

For our first installment, let’s find the Google reviews of a random car dealership and dive into some of the more secretive aspects of a transaction.

You’ve heard about the shenanigans when the customer works with the finance manager in the F&I (Finance and Insurance) department. This is the place where transparency and cost-benefit analysis aren’t always easy for the average car buyer to process. The result is often a bunch of sketchy-looking up-charges on a vehicle’s sales contract.

We hit the jackpot here: The Google reviews for the first dealer we chose featured customers sharing frustrations with getting approved for a new vehicle.

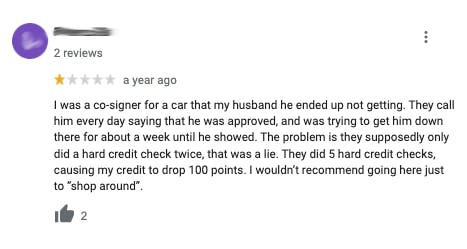

1. Credit checks and shotgunning

In this review, we see the buyer needed a co-signer to secure financing. Dealer F&I managers can and will shotgun a loan application (shop it around to multiple lenders) to see if your finances are adequate. With this transaction, they likely needed to shotgun both parties on the application.

Shotgunning is a double-edged sword. On the plus side, you get a lot of feedback from banks in short order. The downside is how these repeat applications can negatively impact your credit rating, especially if you’re just casually shopping.

There’s nothing to be gained or learned by passing judgment on the review above, so instead, I’ll simply recommend the following:

1. Create an account with the three credit-reporting agencies (here, here, and here). Then freeze those accounts, which will make it harder (next to impossible?) to get your credit shotgunned by an F&I manager.

This is a free process and also helps reduce the risk of identity theft. It takes all of 5–10 minutes to do this, so please consider doing it!

2. When you’re ready to buy, know your credit score before you walk in the dealer’s door. Same goes for any purchase inquiries you make online.

3. Try to fix any blemishes on that report before buying. Be judicious—it may not always be necessary or even possible. But if you can, and you think it will matter, do it.

4. Use an online affordability calculator to get a rough idea of just how much car you can afford. Most importantly, be realistic about the numbers you type into it. Then stick to what the calculator says—no fudging because you really wanted that extra $9000 of gold-painted floormats and, really, what’s another $500 a month?

5. Secure third-party financing (banks, credit unions) before you even enter a dealership. You might not need it, because dealers will work hard to undercut any deal you bring. But they won’t feel the pressure unless you apply it.

Above all, as a customer, you have the right to make it painfully clear when you want your credit run—even to the point of meeting someone in the F&I department, immediately after walking in, to ensure transparency, before you give someone your driver’s license.

That said, I understand that this isn’t always an easy ask. I only lament a lack of transparency: Perhaps the salesperson in our review above was hot-to-trot and the customer didn’t tell them to cool their jets? Or maybe the F&I manager did as they pleased behind the scenes, because they weren’t aware of the customer’s concerns. Or they didn’t care.

Or the customer never spoke up? You be the judge.

***

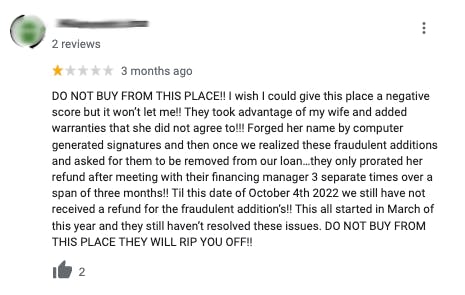

2. Read the fine print, because F&I ain’t talkin’

While forging liar loans does happen (see the examples below), odds are that this review is more about a customer being misled via omission, before a third party (i.e. a family member) explained what they did wrong. I’ve seen it from both sides—third parties are really, really good at instilling buyer’s remorse.

F&I folks often use a customer’s blissfully ignorant silence as a closing tool. A dealer’s F&I department should approach the closing of a sale like a school teacher going over an assignment. Potential charges run the gamut from possibly beneficial add-ons, like GAP insurance, to overpriced nonsense like fabric-protection packages. That said, I’ve seen people justify the need for almost every F&I add-on, and that’s fine: Cars are disturbingly expensive these days, and peace of mind comes differently for everybody. Some of us need all the protection we can get.

I personally recommend a wheel-and-tire protection package: All things considered, they’re cheap, especially next to replacing a 20-plus-inch wheel and a low-profile tire after you kiss a pothole or smack a curb. If the car you’re buying has alloy wheels, it’s absolutely a good service—haggle on the cost, and don’t be afraid to ask how much money the dealer is making on the package. (I vaguely remember these things carrying a margin of between 5 and 15 percent, but don’t hold me to that.)

The problem in this review is that the F&I manager likely didn’t explain every charge on the final bill. Or perhaps they did, and it was in one ear and out the other, because the customer simply wanted to get heck outta there?

While Carvana gets all the press for a seamless buying process, the reality is that more dealerships are using automated software like RouteOne to speed up the transaction.

And that technological advance makes the problem of getting misled in the F&I department even more of a concern: Who wants to read all the fine print on a screen or tablet? Well, you better read it, because canceling those packages takes weeks from the vendor, and dealership employees aren’t usually motivated to keep you abreast of the process. And best of luck if the F&I employee you worked with left the company after you made your purchase, because odds are they didn’t leave good notes for the next person in line.

***

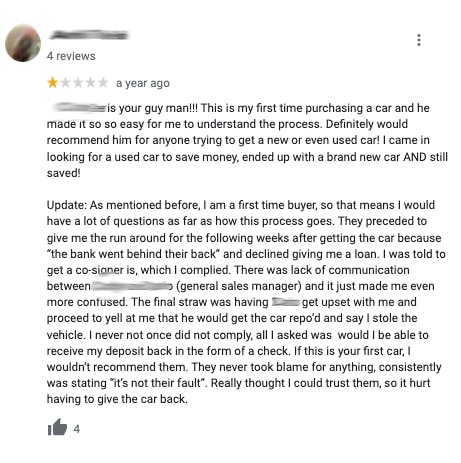

3. Liar loan or jump the gun?

These types of reviews are dicey, as blame can land with either the customer or the F&I department.

If it’s the customer’s fault: The customer could have misrepresented their finances, bamboozling the F&I department into a conditional sale before closing time.

This means the F&I manager intends to complete the bank’s paperwork in the future, letting the customer drive off in their new ride. Customer feedback like “get the car repo’d” suggests that financing was not successfully secured for a plethora of reasons, including the likelihood of the customer misrepresenting their financial health. So then the dealer must ask for their vehicle back.

Dealers don’t like to threaten customers, but sometimes they paint themselves into a corner and do just that.

If it’s the dealer’s fault: It’s the end of the month, the bank or banks are dragging their feet, and the F&I department knows the sales team needs to sell whichever vehicle landed on their desk. (The customer stated their initial intention to buy used, but the dealer likely discounted a new vehicle to make the payments work.)

The F&I manager assumed the bank’s issues could be addressed in the future, so they threw the keys to the customer and called it a day. But they were wrong, and they now have a very unpleasant call to the customer. Which, for a first-time buyer who did nothing wrong, is beyond humiliating.

In the last scenario, the customer could be very proud of being able to afford a new car, especially in today’s economy. They might have even told their family and bragged about the purchase on social media. My goodness, it’s gonna be painful to back away from that—to realize that a dream come true was actually just a lie.

Either way, this is a lose-lose situation. It’s beyond unfortunate, but it happens in the rush to sell a car.

***

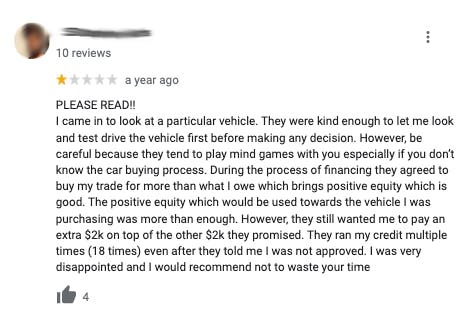

4. Mystery additions or a liar loan?

F&I departments are not in the business of saying no to customers. At least not intentionally.

An “extra $2K on top” of a deal doesn’t happen by magic. In this case, one party was misleading the other as to the value of a trade-in or on the viability of the customer’s finances. Perhaps, when shotgunning those 18 loan applications, someone lied about salary or employment history or the value of the vehicle(s) in question. Either party can initiate a liar loan, but the matching $2000 figures in the review suggest backroom infighting because someone messed up one aspect of the deal.

Who is to blame? Maybe it’s the used car appraiser, the F&I manager, or the customer?

***

Bonus Round: Beware of the packs!

Used-car pricing is all over the map: The likes of Carvana and Carmax are generally at the top, while hungrier used-car retailers are looking to sell volume in a manner more tied to a vehicle’s holding costs over time. That’s an oversimplification of the industry, but still, dealership used-car departments often use a “pack” of add-ons—window tinting, chemical treatments, etc.—to claw back profit from an otherwise cheap, used car. (This is another reason why new cars can be more affordable than used ones, as witnessed in our third review.)

Packs are rarely disclosed until the customer is standing on the lot, looking at the vehicle. I am no fan of packs, as they are disingenuous to both the customer and the dealership’s staff. Everyone needs to make money and pay living wages. Wouldn’t it be nice if every used-car retailer just bumped up prices accordingly and stopped misleading buyers?

***

What did you think of Reputation Management? Was this a good use of your valuable time? Would you like to see more—and if so, anything you’d change or add?

We’re always open to suggestions from the Hagerty Community, and if there’s a type of business you want to discuss, odds are we can find it online. Tell us what you think in the comments!

Great job Sajeev!

It’s good to know that the wheel and tire package is probably worth it…and you can negotiate on the price.

Freezing your credit with the three bureaus is smart. I did it three years ago after my W2 was stolen out of my mailbox.

Thanks Gregg, sorry to hear that happened!

Not all car dealers are crooks and not all shoppers are saints. Being armed with solid information is great going into a dealership, but the single most valuable way to protect yourself is the willingness to walk. Back in 1984 when the Dodge Caravan was the hottest thing around and in short supply many dealers were trying to sell over sticker. When my wife sat down with the salesman to finalize our price she asked, “What’s this $2,000 LOA?” The reply was, “Oh, that’s for Lack Of Availability.”

“Well, we’re not paying that!” And the $2,000 disappeared like magic.

Find a car you like, make a reasonable offer, and let the salesperson decide whether he or she wants to go to the Sales Manager and explain why they let a qualified buyer leave without a car.

Great, informative article. Thanks.

The article is practically an advertisement for skipping cars with dealerships and order online. That’s how I bought my last 3 cars. Ordered online, paid when the car arrived and was on my way.