Reputation Management: Welcome to the Jungle!

Welcome to Reputation Management! In this new series, we’ll explain the oft-mystifying behavior of your local automotive industry—places like car dealers and service shops.

First, we’ll dig into publicly available customer reviews for those businesses. Then we’ll remove the names and discuss the situation from multiple viewpoints, leaning on my years of experience as a—you guessed it—reputation manager.

If we do this right, you should walk away a better, smarter consumer. Let us know what you think in the comments! —Sajeev

***

For our first installment, let’s find the Google reviews of a random car dealership and dive into some of the more secretive aspects of a transaction.

You’ve heard about the shenanigans when the customer works with the finance manager in the F&I (Finance and Insurance) department. This is the place where transparency and cost-benefit analysis aren’t always easy for the average car buyer to process. The result is often a bunch of sketchy-looking up-charges on a vehicle’s sales contract.

We hit the jackpot here: The Google reviews for the first dealer we chose featured customers sharing frustrations with getting approved for a new vehicle.

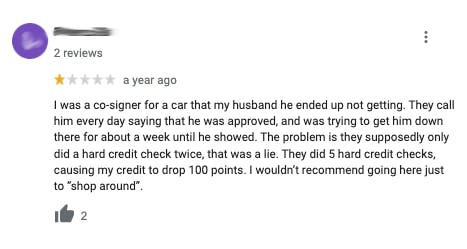

1. Credit checks and shotgunning

In this review, we see the buyer needed a co-signer to secure financing. Dealer F&I managers can and will shotgun a loan application (shop it around to multiple lenders) to see if your finances are adequate. With this transaction, they likely needed to shotgun both parties on the application.

Shotgunning is a double-edged sword. On the plus side, you get a lot of feedback from banks in short order. The downside is how these repeat applications can negatively impact your credit rating, especially if you’re just casually shopping.

There’s nothing to be gained or learned by passing judgment on the review above, so instead, I’ll simply recommend the following:

1. Create an account with the three credit-reporting agencies (here, here, and here). Then freeze those accounts, which will make it harder (next to impossible?) to get your credit shotgunned by an F&I manager.

This is a free process and also helps reduce the risk of identity theft. It takes all of 5–10 minutes to do this, so please consider doing it!

2. When you’re ready to buy, know your credit score before you walk in the dealer’s door. Same goes for any purchase inquiries you make online.

3. Try to fix any blemishes on that report before buying. Be judicious—it may not always be necessary or even possible. But if you can, and you think it will matter, do it.

4. Use an online affordability calculator to get a rough idea of just how much car you can afford. Most importantly, be realistic about the numbers you type into it. Then stick to what the calculator says—no fudging because you really wanted that extra $9000 of gold-painted floormats and, really, what’s another $500 a month?

5. Secure third-party financing (banks, credit unions) before you even enter a dealership. You might not need it, because dealers will work hard to undercut any deal you bring. But they won’t feel the pressure unless you apply it.

Above all, as a customer, you have the right to make it painfully clear when you want your credit run—even to the point of meeting someone in the F&I department, immediately after walking in, to ensure transparency, before you give someone your driver’s license.

That said, I understand that this isn’t always an easy ask. I only lament a lack of transparency: Perhaps the salesperson in our review above was hot-to-trot and the customer didn’t tell them to cool their jets? Or maybe the F&I manager did as they pleased behind the scenes, because they weren’t aware of the customer’s concerns. Or they didn’t care.

Or the customer never spoke up? You be the judge.

***

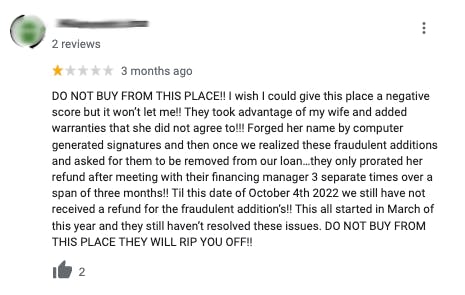

2. Read the fine print, because F&I ain’t talkin’

While forging liar loans does happen (see the examples below), odds are that this review is more about a customer being misled via omission, before a third party (i.e. a family member) explained what they did wrong. I’ve seen it from both sides—third parties are really, really good at instilling buyer’s remorse.

F&I folks often use a customer’s blissfully ignorant silence as a closing tool. A dealer’s F&I department should approach the closing of a sale like a school teacher going over an assignment. Potential charges run the gamut from possibly beneficial add-ons, like GAP insurance, to overpriced nonsense like fabric-protection packages. That said, I’ve seen people justify the need for almost every F&I add-on, and that’s fine: Cars are disturbingly expensive these days, and peace of mind comes differently for everybody. Some of us need all the protection we can get.

I personally recommend a wheel-and-tire protection package: All things considered, they’re cheap, especially next to replacing a 20-plus-inch wheel and a low-profile tire after you kiss a pothole or smack a curb. If the car you’re buying has alloy wheels, it’s absolutely a good service—haggle on the cost, and don’t be afraid to ask how much money the dealer is making on the package. (I vaguely remember these things carrying a margin of between 5 and 15 percent, but don’t hold me to that.)

The problem in this review is that the F&I manager likely didn’t explain every charge on the final bill. Or perhaps they did, and it was in one ear and out the other, because the customer simply wanted to get heck outta there?

While Carvana gets all the press for a seamless buying process, the reality is that more dealerships are using automated software like RouteOne to speed up the transaction.

And that technological advance makes the problem of getting misled in the F&I department even more of a concern: Who wants to read all the fine print on a screen or tablet? Well, you better read it, because canceling those packages takes weeks from the vendor, and dealership employees aren’t usually motivated to keep you abreast of the process. And best of luck if the F&I employee you worked with left the company after you made your purchase, because odds are they didn’t leave good notes for the next person in line.

***

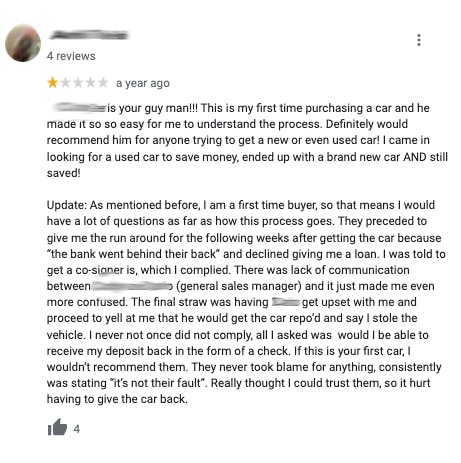

3. Liar loan or jump the gun?

These types of reviews are dicey, as blame can land with either the customer or the F&I department.

If it’s the customer’s fault: The customer could have misrepresented their finances, bamboozling the F&I department into a conditional sale before closing time.

This means the F&I manager intends to complete the bank’s paperwork in the future, letting the customer drive off in their new ride. Customer feedback like “get the car repo’d” suggests that financing was not successfully secured for a plethora of reasons, including the likelihood of the customer misrepresenting their financial health. So then the dealer must ask for their vehicle back.

Dealers don’t like to threaten customers, but sometimes they paint themselves into a corner and do just that.

If it’s the dealer’s fault: It’s the end of the month, the bank or banks are dragging their feet, and the F&I department knows the sales team needs to sell whichever vehicle landed on their desk. (The customer stated their initial intention to buy used, but the dealer likely discounted a new vehicle to make the payments work.)

The F&I manager assumed the bank’s issues could be addressed in the future, so they threw the keys to the customer and called it a day. But they were wrong, and they now have a very unpleasant call to the customer. Which, for a first-time buyer who did nothing wrong, is beyond humiliating.

In the last scenario, the customer could be very proud of being able to afford a new car, especially in today’s economy. They might have even told their family and bragged about the purchase on social media. My goodness, it’s gonna be painful to back away from that—to realize that a dream come true was actually just a lie.

Either way, this is a lose-lose situation. It’s beyond unfortunate, but it happens in the rush to sell a car.

***

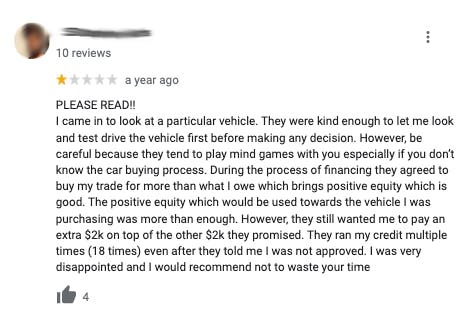

4. Mystery additions or a liar loan?

F&I departments are not in the business of saying no to customers. At least not intentionally.

An “extra $2K on top” of a deal doesn’t happen by magic. In this case, one party was misleading the other as to the value of a trade-in or on the viability of the customer’s finances. Perhaps, when shotgunning those 18 loan applications, someone lied about salary or employment history or the value of the vehicle(s) in question. Either party can initiate a liar loan, but the matching $2000 figures in the review suggest backroom infighting because someone messed up one aspect of the deal.

Who is to blame? Maybe it’s the used car appraiser, the F&I manager, or the customer?

***

Bonus Round: Beware of the packs!

Used-car pricing is all over the map: The likes of Carvana and Carmax are generally at the top, while hungrier used-car retailers are looking to sell volume in a manner more tied to a vehicle’s holding costs over time. That’s an oversimplification of the industry, but still, dealership used-car departments often use a “pack” of add-ons—window tinting, chemical treatments, etc.—to claw back profit from an otherwise cheap, used car. (This is another reason why new cars can be more affordable than used ones, as witnessed in our third review.)

Packs are rarely disclosed until the customer is standing on the lot, looking at the vehicle. I am no fan of packs, as they are disingenuous to both the customer and the dealership’s staff. Everyone needs to make money and pay living wages. Wouldn’t it be nice if every used-car retailer just bumped up prices accordingly and stopped misleading buyers?

***

What did you think of Reputation Management? Was this a good use of your valuable time? Would you like to see more—and if so, anything you’d change or add?

We’re always open to suggestions from the Hagerty Community, and if there’s a type of business you want to discuss, odds are we can find it online. Tell us what you think in the comments!

Great information and clarification of some of the common issues. Thank you!

So glad you enjoyed it!

From what I understand, multiple credit inquiries in a very short period of time are understood as “one” inquiry. If my credit is checked on Friday at Ford and Saturday at Chevrolet and Monday at Toyota the credit reporting agencies see this as one inquiry.

That’s what I thought too, but it seems like it can have a more negative compounding effect if the person in question has other issues at the same time. Hard to know from my vantage point, as an individual’s complete credit history is hard to discern (for good reason).

I enjoyed this article, even though the 4 vehicles I’ve bought at a dealer were all used and $14k or less and only 1 of those was financed. For the $14k one, i wrote a personal check for $11k and told them I could bring the rest from my bank the next day. The dealer had no issue with me driving the car home. The bank however, had a big issue the next day. My wife and I were young and newly married, and I had only ever had 1 credit card. No other line of credit to my name except the one card that had never carried a balance to the next month, and zero line of credit for my wife. The bank that I had banked at for 8+ years didn’t want to loan me $3k on a car that was valued at $16k. It took over an hour to convince them that loaning us, two long-time customers that were full time employed in the engineering and medical field, only $3k for a $16k car was low-risk. They finally agreed and I paid it off the following month once I sold another vehicle.

Oof. Odds are the finance department at the dealership could have done it easier for you, as they know the right people to secure funding from multiple lending institutions at higher levels than a local bank. It’s insane how that works sometimes…but I hope the bank at least gave you a decent rate.

I don’t remember the rate, but since I paid it off the following month I remember it ended up costing an additional $50 or so, less than $100 for sure. The bank did another dumb thing a few years later when we borrowed money for our first house. My two lines of credit at that time were my 1 credit card, and this car loan. My wife still had nothing. At this point we had been employed in the engineering and medical fields for 3+ years, neither of us having jumped different employers. The bank gave us a higher interest rate to include my wife’s income on the loan, since her score was “low.” So they gave us a lower rate to buy a house using just me and not putting her on the loan. Now that’s stupid. All because we had 1 card (that never carried a balance) and 1 car loan that lasted 2 months.

I wish I had the insight to understand why loan decisions like that exist, but I do not! Wow, that’s awful.

I’ve worked at two dealerships in my life time, everything from lot attendant to salesman to line tech. Ask me about the shady stuff I’ve seen!!!!

what shady stuff have you seen

Each of these “situations”, applied to any other transaction (real estate, rentals, other retail sale) would be considered fraud and there are statutes in most states to protect the consumer. The dealership industry has been able to protect their entirely disingenuous business model that preys on gullible shoppers. (Massive campaign contributions or just millions spent on lobbying?) My state just recently (finally, after 110 years!!) passed a law that made it illegal for a dealership to play “bait and switch” with advertised vehicles. Sorry, but “Reputation Management” in an industry that plays fast & loose with existing laws, and is based on tricks and illusion needs a regulatory overhaul and Compliance Managers.

My advice: avoid all this credit nonsense by paying cash, especially for “toy” cars. I’m of relatively modest means, but I’ve never financed anything beyond my mortgage. That means I’ll likely never own a brand-new Porsche or Ferrari, but I also won’t be paying thousands of dollars in interest or taking bogus credit score hits.

I was raised to believe that if I don’t have the cash, I just can’t afford it.

I wouldn’t say I “enjoyed” this article, because it was rather painful to read, given all of the potentially painful examples of what I might run into if I try to finance a car purchase. But it was certainly informative, and it’s confirmed my intentions to never again set foot in a dealership to buy a new vehicle (and only to pay cash if dealing on a used one).

You got something out of it, and that’s good enough for the author! 😉

Good article and column premise.

/salute to Sajeev for successfully writing with different hats on and each voice works (Vellum Venom, Piston Slap, The Valentino Project…)

And I salute you for reading all the byproducts of my mind. Thank you very much.

Here, here -snailish nailed it again!

Aww, you guys are the best.

Why allow a car dealer to take control, play their well-honed game and make the profit off the financing?

No recommendation for a Credit Union? How about walking in with the money part done?

Exactly. The last several new cars/trucks I bought, I did just that. Went to my Credit Union, set my rate, then just told the dealership to call the C.U. to arrange for a check. Of course, the last new vehicle I bought was 15 years ago, and the deal was much more straight-forward than some of these example indicate (like adding things to the contract after it was signed). It seemed simpler then: [ick a vehicle, negotiate to a price, get the C.U. to pay that price, and hang the keys on a peg in my kitchen. Seems like it must nt be that way anymore.

For the last 20 years, I have been working with a car broker. I pick out a vehicle, he either orders it or pulls it from inventory (lots of different dealers), shops for financing (lease or purchase, if it makes sense), at the best deal for me. Secures the vehicle, at or below dealer invoice, with all of the “pack stuff” on the vehicle, but at no charge. He calls when it’s detailed and ready, a few signatures and i get to enjoy a new ride. He gets a flat $500 for his efforts, and I get a hassle free transaction, that I know was in my best interest. He has even worked with kids (limited credit) and some people with difficult credit, always looking for the best value solution. More people need to be aware of car brokers and their ability to represent the customer’s best interests. Dealers are the enemy.

I mentioned “Secure third-party financing” but you are right, so I have clarified that with a mention of both banks and credit unions. Best thing about doing this is the F&I manager is under pressure to beat that deal, and every time I’ve recommended someone do this, the F&I department beat it. Two banks and one credit union lost these deals, if I recall correctly. But F&I won’t try hard at all unless you come in “with the money part done” as you so perfectly said!

Often you can actually get better financing from a dealer than your own bank or credit union. Car dealers sell a LOT of cars and banks just love the volume, so often they’ll give preferential rates to through-the-dealer financing. Dealers often have “buy back” agreements in place so if someone defaults on a car loan, the dealer repos the car and buys the loan back from the bank. That lowers the risk for the bank, and they just LOVE that. The bank doesn’t have to find a repo company, store the car, secure the car, recondition the car, sell the car, the dealer does it all.

I have very, very good credit (well over 800) and a Honda dealer was able to finance a 2008 CLK 350 at a significantly lower rate than my credit union or two banks, one of which I had over 70K unencumbered cash deposited there. (It isn’t there any more . . . I found out who my friends aren’t.)

Nice! Glad to see your experience mirrors mine, but I will say that for most folks (maybe everyone) its a wise move to secure outside financing before you walk in, so you can make them beat it. While knowing what the customer will pay in terms of an APR might allow them to make more money than they originally anticipated, flying blind in the finance department is generally not a good idea.

GREAT article – should be required reading for anyone buying a car from a dealership!!!

I recently helped my niece buy her first car. The dealership’s (not to be named) salesperson and literature both repeatedly promoted that every car they sold, “…came with…” a protection package that included the usual paint/fabric/glass etching/etc. nonsense. However, when we got to F&I there was a $2000 charge for this “…came with…” package. I argued that ‘came with’ was different than ‘pay for’ and told them I felt that was dangerously close to fraud. They removed the charge…w/o any fight, I’ll add.

I also always refuse rights to my information *and* for them to put exterior badging on the car. That information has value to the dealership and if they want it, we can re-negotiate the sales price. The F&I guy got real upset with me telling my niece that…more so than the protection package stuff!

Thanks for sharing, Chris. Glad the F&I person worked with you, one time I was tag teamed by two of them when helping a friend buy a car. I threatened to tell the salesperson that he wasn’t getting a sale because I hate being tag teamed…they finished the transaction up real quick after that.

Jeeves, that’s a surprisingly valuable set of advices you’ve given, so I’m proud that my mid century modern coffee table ended up with a responsible user. Cheers.

And I am proud to have said table.Thanks for reading!

I’ve seen some scummy F&I types and salesmen but I have also learned a long time ago that internet reviews are to be taken with a grain (or many) of salt. My favorite place is yelp where people go to crap all over companies they never purchased anything from like they have an agenda. Yelp will help business who pay to filter out the reviews from people who never visited the place but if you don’t pay, they stay for eternity. So you can’t trust what you see.

Seriously… Your comment is awaiting moderation.

Why does this happen all the time.

Gary

I’m not sure of the official, technical explanation, but it happens to me sometimes as well. I always thought maybe the longer the post I make, the more likely it was to be held, but once in awhile, I see just a one or two sentence comment held for a bit, so it may have to do with an algorithm that spots certain wording or something that they want an editor to peruse before publishing – just in case. I’m only guessing, of course, because I’m hard-pressed to see words in your posts that might arouse suspicion. It’s always possible that the wait is simply because Sajeev is on coffee break or something…😄

The first 8 years at my current company (a multi-billion asset Credit Union in the Great Lakes region) was overseeing the Indirect Lending program and managing our portfolio of about 150 (at the time) dealership relationships. I cannot speak for banks, but at the Credit Union we don’t spot out loans like the 3rd item, but we did bail the dealerships out many times when they did do that and came to us begging for us to save the deal so they didn’t have to take the car back. Thankfully our Credit Union is built to help those with less than stellar credit and we saved a lot of them. That said, having seen the back-end of these deals, I would say most of the items listed here were in fact the dealership’s/dealership employee’s doing, and pretty rarely was it misrepresentation of finances by the buyer (not that this didn’t happen too, just not frequently).