The biggest moments at Monterey

The Monterey auctions have wrapped with a sales total of $469M—a new record. For a blow-by-blow of the week’s biggest moments, read on. Click here for our concluding report, and here for details on the top-earning car.

Let’s come right out and say it’s an interesting time to be heading to auctions in Monterey. We see the same headlines as you, after all. Inflation is up. Interest rates are up. Corporate earnings are down. Closer to home, there are signs the pandemic-fueled frenzy for alternate investments—from Bitcoin to watches and, yes, cars—is slowing.

On the other hand, a Ferrari Dino just sold for record money on Bring-a-Trailer, an E-Type came awfully close, and for certain Japanese classics, rationality seems to have gone out the window altogether. Those high sales are backed up by what we’re seeing in the market overall. Demand remains very strong, and it’s coming from a broader swathe of the population than ever before. Owners report no problem finding buyers. Hagerty’s new Marketplace has huge participation.

Which brings us to this pivotal week. The ecosystem of buying and selling cars has expanded dramatically over the past few years, yet particularly for high-end collectors, Monterey in August is still the glowing hot center of the action. That’s especially true this year. The number and quality of cars at Monterey is unprecedented, with a bumper crop of significant Ferraris, race cars, and ultra-rare stuff you won’t see anywhere else.

Predicting what’ll happen at the auctions is a fool’s game—although we’ve done our best here. Two things we can say for certain: It’ll be exciting and we’ll be there for every second of it. (Check out our events calendar if you want a sense of when auctions take place.) We’ll be posting live updates here throughout the week, so bookmark this page and check back for the latest action.

Meantime, check out our extensive preview coverage:

- For a snapshot of the collector car market heading into the auctions, see our latest update to the Hagerty Market Rating, which dropped for the second straight month. Once again, the big reason is inflation. Collector cars are still appreciating, but few can keep up with the dollar.

- To better understand what we expect to happen—and why we could be wrong—read our full forecast.

- We’ve drooled over the top-estimate cars and explained why this will be a fascinating week for Skyline GT-Rs, Tesla Roadsters, and of course Ferraris.

Wednesday, August 17, 5:30 pm: You know how it feels when it feels like all the stars are ready to align? That’s the vibe I’m getting from the auction houses and the bidders. It means record-shattering things are potentially about to happen.

One wrinkle: I didn’t see a host of European bidders. Many European collectors stayed home last year due to COVID precautions. This year, the worry is they’ll sit out because of unfavorable exchange rates. Of course, we won’t really know until the first auction.

— Dave Kinney, publisher, Hagerty Price Guide

To Dave’s last point, we have bumped into quite a few British dealers and notables, including F1 driver Jenson Button, who seemed quite interested in RM Sotheby’s Ferrari 400i, and Gordon Murray, who told us he’s rather bemused to see his McLaren F1 become an eight-figure darling of these events and thus too valuable to be driven extensively. His T50 and T33, he added, aim to deliver the experience to those with (relatively) smaller wallets.

More broadly, there’s definitely a “buzz.” Maybe it’s the level of machinery on display—absurd even by Monterey standards—or perhaps it’s the heated state of the market, which even industry insiders here tell us they can’t quite wrap their heads around. Whatever it is, even the jaded, seen-every-Dawn-Patrol types seem to be anticipating a big year. — David Zenlea, managing editor, Insider

5:45 pm: RM’s McLaren F1 and XJR-15 is an offering of two mid-engine naturally aspirated V-12 manual supercars from the 1990s that aren’t Ferraris or Lamborghinis. Just a reminder of how quickly the values of ’90s performance cars have risen. —Conner Golden, features editor, Insider

Thursday, August 18, 7 AM: Today we begin to see if the hype for this year’s Monterey sale translates into, you know, sales. Cars will cross the block for Broad Arrow* and Mecum.

9:27 AM: The R34 GT-R at Mecum was extremely cool. It’s one of the earliest R34s in the states, was loaned to Paul Walker and appeared at SEMA back in the early 2000s as well as a BF Goodrich ad campaign. All that in mind, Mecum attendees had little interest or understanding of what the car was. Car felt like a fish out of water in a sea of muscle cars and muscle car enthusiasts. — Greg Ingold, editor Hagerty Price Guide

9:40 AM: We’re seeing efforts here to amp up the in-person auction experience. RM Sotheby’s Ferrari F40 is being sold by a sealed-bid process. Submit a bid, and you’ll see on an app the rank of your bid (but not the high bid number). You’re able to up it as much as you like. Interesting game-ification. Over at Broad Arrow*, the auction preview last night was integrated with Motorlux (formerly McCall’s Motorworks Revival), essentially guaranteeing a solid attendance and positive atmosphere. — Eddy Eckart, senior editor, Insider

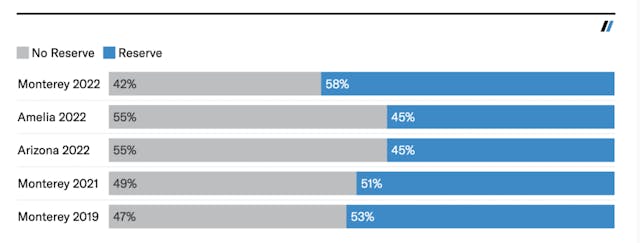

10:50 AM: The number of no-reserve lots can indicate sellers are confident in the market or feel the need to guarantee an asset sale today before the tide turns. The catalog auctions at Monterey this year have the highest percentage of reserve lots amongst Arizona, Amelia, or the previous two years of Monterey, and that points to sellers being uneasy which way the market will turn but they sure aren’t having a fire sale. — James Hewitt, Senior Data Analyst

2:24 PM: Monterey has long proven to be a lift for Ferrari supercars, and last year’s record-setting Ferrari F40 run at Monterey we wrote about proved how far values can move in a year. This year could be the Ferrari F50’s record-setting turn at bat if estimates and collector buzz in the tents are anything to go by. If the two F50s on offer sell for their high estimate they will become the two highest sale prices ever for an F50. The three F40s with estimates will slot near the top of the charts but nowhere near the exponential rise of the F50. — James Hewitt, Senior Data Analyst

5 PM: I had an extended conversation with a pair of F50 owners/big collectors on their perspective of the market. One said he’s seeing collectors accumulate multiple examples of big 1980s/1990s cars while the other collector mentioned he has two F50s. He knows of one US collector with 4(!) F50s, mostly on the basis of future speculation.

He thinks we’re approaching the slow decline for mid-century Ferraris, with values tapering off and the 288/F40/F50/Enzo rising up to fill the $6m-$15m delta going forward. He muses that while 250 GT SWBs will always have value, future collecting will prioritize the usability, performance, and comparative approachability of the 1980s/1990s icons.

5:10 PM: Monterey proves successful for James Bond Astons once again. Sean Connery’s Aston Martin DB5 sells for $2.425M all in after a quick back and forth, eclipsing its $1.8M high estimate and gaining a nearly 100 percent premium over the #1 value of a standard car. How does that fare versus a “real” James Bond car? Well, one of those sold for $6.387M at 2019 Monterey, a 340 percent premium over the #1 value at the time. — James Hewitt, Senior Data Analyst

5:15 PM: Sure, James Bond is cool, but how about $106k for Broad Arrow’s Karmann Ghia? That’s some $20k above our #1 (concours condition) Price Guide value. (Lest you think the one in your driveway is suddenly worth six figures, note that it was a really nice Karmann Ghia. Our value for a driver-condition model is still just over $30k. — David Zenlea

5:25 PM: Mecum ends their first day of the auction with $3.4M in cars sold for an average sale price of $28.3k. That’s $1.3M more than 2019’s first-day total (despite 2022 having 22 percent fewer lots) and $700k less than 2021’s number. — James Hewitt, Senior Data Analyst

5:51 PM: Every penny matters, even at $4.5M. With bidding creeping up by $25k increments in the final minutes, Broad Arrow’s Ferrari F50 sets a new world record price for an F50. The final price of $5.175M beats the previous record of $4.675 set only 6 months ago at RM’s London Motor Show Week sale. We can confirm our chart above, the F50 is on a run. — James Hewitt, Senior Data Analyst

6:01 PM: Not long after the F50 hit it big, a 540K missed with a high-bid of $6.25M. With something like a dozen 500/540Ks on offer this week, perhaps bidders are keeping their powder dry. — David Zenlea

6:26 PM: Over at RM, another 540K (lot 108) had more luck. A lot more. The room went quiet when bidding jumped from $7M to $9M. The final price of $9,905,000 is the 2nd highest ever for a 540K. (The record was set in Monterey way back in 2012.) — John Wiley, manager of valuation analytics, Hagerty

7:14 PM: Sure, $106k for Broad Arrow’s Karmann Ghia was a lot. By how much? Enough to make the previous record of $86k look like an average sale… Take a look at this chart of Karmann Ghia sales since 2010 — James Hewitt, Senior Data Analyst

7:34 PM More recent exotics have been moving here at Monterey Jet Center, with Broad Arrow recording strong sales for a BMW M1 (see chart) and a Porsche 959 joining the F50. — David Zenlea

7:35 PM: Meanwhile, at the Portola hotel, we’re seeing lots of older restoration prewar cars. Most all are selling. — John Wiley

8 PM: I saw some spectators looking hopefully at Broad Arrow’s Honda Z600 as an attainable car…and then sighing when they spotted the $30–$40k estimate. They probably weren’t happy to see it go for $56k—$25k over its Condition #1 value in the Hagerty Price Guide. — David Zenlea

8:13 PM: RM’s Tulipwood Hispano sold for $8.4m hammer to a reverent crowd. — Brian Rabold, Vice President, Hagerty Automotive Intelligence

11:05 PM: Day one concludes with 227 cars selling for $89.1 million. You can read our full report here. Tomorrow, Gooding and Bonhams join the fray, and RM Sotheby’s will be selling cars from the massive Oscar Davis Collection. We’ll be there.

Friday, August 19, 10:16 AM: The day’s auctions are just opening here in Monterey, but on Bring a Trailer, a 1995 Ferrari F50 just sold for $3.31M. Slightly higher mileage and slightly less desirable European specification compared to the record-setting F50 that sold last night. But still…$3.31M. As recently as 2020, that would have been an earth shattering price for a Ferrari that once lived in the shadow of both the earlier 288 GTO and the newer Enzo. Also not long ago, it would have been earth shattering for it to have taken place on the Internet. Now it’s just another Friday morning. And remember: Gooding & Company also has an F50, previously owned by Mike Tyson no less.

11:55 AM: While the auctions are spinning away and grabbing headlines, dealers and market makers ink deals and trade cars on the peninsula in the background all week long. We estimate for every one car sold at auction in a year eight are sold on the private market, and those private market sales can be big. Exotic car dealers We Are Curated and The Cultivated Collector collaborated at Monterey to set a new record price for an AMG Hammer 6.0 private treaty sale. The auction record was set last week at $761k. — James Hewitt, Senior Data Analyst

12:09 PM: Meanwhile, over at WeatherTech Raceway Laguna Seca, we’re witnessing a battle of the brand bosses. Ford boss Jim Farley is piloting a 1966 289 Cobra and a 1978 Lola T289 prototype while McLaren Racing CEO Zak Brown is in his 1989 Jaguar XJR-10 and a 1982 Porsche 935. — Cameron Neveu, Editor and Photographer

1:04 PM: Sean Connery’s DB5 fetched a 100% premium over the #1 price guide value yesterday, and Humphrey Bogart’s 1956 Ford Thunderbird gained a 60% premium over the #1 value today. As always, attach a famous person’s name to a car and the value can easily double. Take a look at this link for other big celebrity cars coming up for sale over the week. — Eddy Eckart, Senior Editor

1:26 PM: Bonhams’ 1926 Rolls Silver Ghost sold for $1.325M, or double the high estimate. Sale of the show, perhaps? Pre-War still has strong legs, even after a handful of no-sales. That high-high was immediately followed by a low-low. 1938 Talbot-Lago (Lot 42) sold for $665k, a cool $250k under the low estimate. — Conner Golden, Features Editor

2:27 PM: One of Bonhams start cars, a Cunningham Lightweight E-Type, went unsold for $6.3M. I’m a little surprised, with E-Types on the comeback trail and given this one’s history, that it didn’t go higher. — Eddy Eckart

Although it’s significant and desirable, it’s not “fresh to market”—a theme we saw here last year. Bonhams sold this very car at Scottsdale not long ago. — Andrew Newton

Here’s another hot take: Much of the E-Type’s newfound mojo is coming courtesy of younger collectors, the sort who want to drive their stuff and—as long as we’re stereotyping here—might not have the patience or knowledge required for a well-used example (we graded the Cunningham E-Type a #3+, meaning a nice driver with some flaws). We’ll see if this theory holds any water later this weekend, when Gooding offers its much less historically significant but oh-so-shiny-and-new Continuation Lightweight. — David Zenlea

2:47 PM: Maybe you can have your cake and eat it too, Bonhams provides nice returns for two nice Porsches. The 1967 911 S sold for $209k in January 2018 and the 1968 912 sold for $44k at Monterey 2019, providing a 55% and 60% gain respectively on each. — James Hewitt, Senior Data Analyst

2:59 PM: Sometimes you might forget the baking powder and that cake won’t taste so good, though. The 1903 Oldsmobile Model R Curved Dash was bought for $47k at Barrett-Jackson’s Las Vegas auction only one month ago. It sells for $30k today, a 36% loss. Arguably, just the experience of driving such a car might be worth the cost — James Hewitt, Senior Data Analyst

3:40 PM: At Gooding, I overheard the consignor of a 1942 Crocker Big-Tank Twin explaining why he’s selling. “It doesn’t make my heart pound.” Willing to bet that’s what’s driving a lot of sellers here—with the market so strong, it’s prime time to get out of things you don’t love. We’ll see if someone else loves that motorcycle enough to meet its $900,000 low estimate. — David Zenlea

If the low estimate is anything to go by and the it sells, that Crocker become the most expensive motorcycle ever sold at auction. It is competing with a 1951 Vincent Black Lightning sold for $929k in 2018 and the current most expensive Crocker of $825k. — James Hewitt, Senior Data Analyst

4:09 PM: Gooding is offering three RUFs today, with the matte paint RT12 getting the most attention and a high estimate double that of the other two. The chart below shows their high estimates as stars (two have the same high estimate of $325k) and the venues sold. Monterey and Porsche-heavy Amelia have dominated the auction market for these, but the online market is putting up a fight as of recently. Don’t get me wrong, it’s never hard to sell a Porsche, no matter what venue. — James Hewitt, Senior Data Analyst

6:23 PM: Gooding has sold a Ferrari F40 for a staggering $3.965M. $1.08M more than the previous record set, you guessed it, last year. — James Hewitt, Senior Data Analyst

6:30 PM: Is that a good or bad sign for the market? The F40 record was broken in 2008 and 2012 and then was broken every year from 2012-2015 during the big runup in values, dare I say the b*bble word, in Ferrari values. It took four years for it to be broken again, and the record has now been reset in 2019, 2021 and now we have our 2022 record. A sign of what’s to come? — James Hewitt, Senior Data Analyst

7:25 PM: So far today the energy has been around the newer classics. But a 1937 Bugatti Type 57, headed for the auction block in mere moments, may have something to say about that… — David Zenlea

7:37 PM: Bidding opened at $5M, then moved slowly and in surprisingly small increments to $9.35M, then a last minute $9.4M high bid ($10.345M final) took the car. — Andrew Newton

7:39 PM: We have this dichotomy wherein the newer classics are blowing estimates out of the water, yet the biggest sales so far have been prewar greats. The collectors who focus on these older cars have a better defined notion of what they “should” be worth, but we can’t forget that can still mean A LOT of money. — David Zenlea

8:50 PM: Gooding’s Ferrari Enzo sold for $4.185M all in, marking it as only the second Enzo to sell for more than $4M at auction. Bested only by the final Enzo built, gifted to the Pope by Ferrari. — James Hewitt, Senior Data Analyst

8:53 PM: “You ask a child to draw a Ferrari and that’s what they draw you” is how the auctioneer described Mike Tyson’s former Ferrari F50 on the block, but it didn’t have the knockout power to unseat Broad Arrow’s F50 record from the day prior. — Greg Ingold, Hagerty Price Guide Editor

Saturday, August 20, 10:00 AM: The third and final day of auctions in Monterey kicks off. So far the story has been record sales and feverish bidding, and we expect that to only continue today as buyers look to return home with what they came to Monterey for.

12:45 PM: A 1959 MGA just sold at Gooding for $168,000. That’s 82% above #1 value and 234% above its price guide condition value. The little Brit has been the biggest surprise of today’s sales so far — Eddy Eckart, Senior Editor

12:55 PM: The 1966 Ferrari 275 GTS is Gooding’s first 7-figure sale of the day, at $1,765,000. This followed a perfect sell-through-rate of the first 23 lots. — Adam Wilcox, Information Analyst

1:02 PM: Lot 131, a 200-mile BMW Z8 was the first no-sale of the day, despite being bid to $400,000 (over #1 value). The first 28 lots sold at Gooding. — Adam Wilcox, Information Analyst

1:31 PM: MGAs love hanging around $30k, and the Twin Cam variant adds only around $20k to the #1 price guide value. Yet this MGA Gooding just sold becomes the fifth MGA to sell for more than $100k at auction. It is only trumped by the MG Works Team Sebring car sold at the 2015 Monterey auctions for $236,500. — James Hewitt, Senior Data Analyst

2:30 PM: And another record for an analog supercar is broken. Gooding has sold a Bugatti EB110 Super Sport, 1 of only 30, for $3.167M. Eclipsing the previous record of $2.75M set a year ago at RM’s Monterey auction. Despite the market shifting to online, a live auction in Monterey still confirms it is the place to gain a world record sale price. — James Hewitt, Senior Data Analyst

4:06 PM: Amidst all the heated sales and world record prices one wouldn’t expect a 1 of 12 1961 Jaguar E-Type Series I coupe (those outside bonnet latches are worth a few hundred thousand dollars) that hasn’t come to market in three years to have a stable market value. Yet, amazingly, Gooding’s E-Type for $632k is less than 1% different from what the exact car sold for in Monterey 2019! — James Hewitt, Senior Data Analyst

6:12 PM: Similar to the pretty sign-of-a-time-gone-by 1936 White National Park buses selling for an unexpected million dollars, RM’s first lot, a 1936 Twin Coach Helms Bakery delivery truck sold for $246,400. That’s more than double the high estimate. We’re not sure it’s nostalgia driving this sale, though, 1936 is 86 years ago. — Andrew Newton

6:31 PM: Speaking of those White Model 706 park buses, the next time someone asks what a White Model 706 bus is worth tell them between $77k and $1.4M. Mecum’s bus was estimated to sell for $200k-$225k — James Hewitt, Senior Data Analyst

7:20 PM: RM sells a 1995 Porsche 928 GTS for $406,500, double the previous record for a 928 (one that wasn’t Tom Cruise’s co-star on the big screen). Why that caveat? Don’t forget the movie car sold for $1.98M in September of last year… The same car brought only $49,500 in 2012. — James Hewitt, Senior Data Analyst

8:26 PM: RM Sotheby’s auctioned off a unique 2022 Porsche 911 dubbed the Sally Special for $3.6M. Customized by Porsche in collaboration with designers at Pixar, the car resembles the character Sally Carrera from the movie Cars. With proceeds benefitting charities: Proceeds to benefit Girls Inc. and USA for UNHCR, the UN Refugee Agency — John Wiley, Manager of Valuation Analytics

9:13 PM: Is Monterey taking the auction crown back from Bring a Trailer? Gooding’s 2008 Ferrari F430 was bought on Bring a Trailer in August 2020 for $250,000 before selling for $412,000 today. More selling fees on the Monterey sale, but a 62% gain is a 62% gain. — James Hewitt, Senior Data Analyst

9:58 PM: A pause at $19.5M. Silence, you could hear a pin drop. A bid at $20M. The star car of the weekend, a 1955 Ferrari 410 Sport Spider, sells for $22.005M. — Adam Wilcox, Information Analyst

10:22 PM: The last few cars are still crossing the block at RM Sotheby’s, but we can already safely say this year’s Monterey sale is record setting.

10:40 PM: The record for a Ferrari F512 M was broken twice today. First at Gooding with a 7,200 mile Rosso Corsa car which sold for $720,000, and then later for a 9,000 mile triple black car that RM Sotheby’s sold for $780,500.

Sunday, 5 PM: We have revised our auction total to $469M to reflect reported post-block transactions.

Are you planning to attend Monterey Car Week? Keep up to date on the latest news and events by subscribing to our special edition newsletter or text Pebble22 to 227588 (CAR LUV) for real-time event updates straight to your phone.

*Hagerty has entered into a definitive agreement to acquire Broad Arrow Group. You can read more about it here.

***

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.