Marilyns and Yeezys: Cars aren’t the only hot collectible market

Mere days after Insider scooped the $142M record sale of the Mercedes-Benz Uhlenhaut Coupe, several editors received a link in a group chat to Andy Warhol’s Shot Sage Blue Marilyn, a painting of Marilyn Monroe that Christie’s had just sold for an eye-watering $195,040,000.

My initial reaction may have been similar to yours—astonishment coupled with some head scratching over the fact that someone would pay that much for, you know, just a picture. Of course, this thought existed in parallel with my ongoing justifications of countless hours and dollars I’ve spent on, you know, just a couple of cars (proportionate to my income, of course—I fall well short of the sequential zeroes necessary for a Warhol purchase). As a result, I don’t plan on casting any stones toward the happy new owner of the Warhol. Instead, my thoughts turned to wondering how closely the massive prices in other parts of the collectible universe—and the reasons behind them—mirror the unprecedented run-ups in the classic car world.

As I spoke to folks in other spheres, it became clear that reasons for why various collectibles cost what they do are as different as the items people collect. Yet the dramatic prices writ large, from art to NFTs to sneakers, clearly owe to some common influences. And nearly everyone shared a similar warning: we are entering a tricky time, when careless and/or profit-focused collectors can get burned.

On Warhols and Washingtons

In order to understand that big price for the 300 SLR, it helps to know something about motorsports history and a little about automotive engineering (enough, at least, to appreciate how bonkers a fuel-injected, desmodromic-valved eight-cylinder was in the early 1950s). In the same vein, to understand the record price for the Warhol, it helps to know a thing or two about art. For that, I reached out to just such an expert: Anita Heriot, president at The Fine Art Group, a company specializing in art investment, appraisal, and sales. Turns out art industry professionals were as shocked about the price of the Warhol as outsiders, but for a different reason.

“We expected the Warhol to easily clear $200M—we were amazed when it didn’t,” said Heriot.

Warhol’s blue-chip status as one of the late-20th Century’s greatest artists has long meant that any of his pieces fetch top dollar, and Shot Sage Blue Marilyn is one in a particularly valued series by the artist. However, there’s something afoot in the art market, and it’s beginning to create a shift in priorities, according to Heriot.

“As with the collector car market, the art world started to see profound changes last year during COVID,” said Heriot. “The record prices are one headline themselves, but combined with the increase of online art auctions, there has been a sea change of interest in next-generation artists as well as a dramatic increase in global Millennial interest in the art world.”

The resulting impact has been twofold: works from artists like Warhol may still break records, but with attention beginning to shift to a new era, those record-setting sales are impacted by more factors than in the past. Further, new-era artists are seeing parabolic trajectories, with prices far exceeding estimates and recent prior sales. The art industry appears to be in the midst of a significant shift of what it values.

Heriot pointed to Anna Weyant, an ascendant young artist who’s found tremendous success of late. According to Heriot, prior to the recent shift, one of Weyant’s pieces fetched a high of $37,000. At a Christie’s auction on May 10, Weyant’s piece, Summertime, had a sales estimate of $200,000 to $300,000. It sold for $1.5M.

Ernie Eugene Barnes, Jr’s work is another example. Barnes’ Storm Dance, a 1977 painting depicting a basketball game against a stormy sky, shattered its $100,000-$150,000 estimate with a $2,340,000 sale. Heriot cited a lengthy list of other examples—these were not isolated occurrences.

I skeptically asked Heriot whether these values would hold. “Frequently, when an artist’s work begins to sell for dramatic prices, other people who own that artist will sell in an effort to get on the train,” she said, and the resulting oversupply drives the market back down. However, the long-term outcome is that the artist may enjoy a higher overall market status than when they began their upward valuation.

If there’s a near-equivalent in the car market, it’s the Skyline GT-R. For a year, Nissan’s monster has led the Japanese-market value charge, but we’re now hearing reports of the same R32 GT-R selling multiple times and appreciating as quickly as 7 percent per week. Such an aggressive increase often precedes a retrenchment, but there is no longer any question that Japanese-market collectibles have staked out a long-term presence in the collector car marketplace.

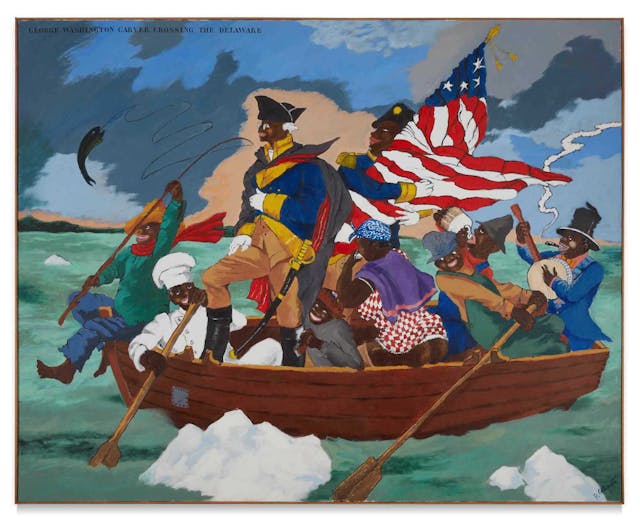

Heriot doesn’t expect interest in canonical works to dry up as a result of new focal points in the art world. If anything, an additional dynamic appears to have emerged: each is informing the other. She pointed to Christie’s sale on May 12 of Emanuel Leutze’s 1851 work, Washington Crossing the Delaware for $45M, which was originally estimated to sell between $15M-$20M. Heriot noted the limited audience for the museum-like piece and suggested that the sale far exceeded estimates due in large part to the excitement surrounding last year’s $15.3M sale of Robert Colescott’s parody piece, George Washington Carver Crossing the Delaware: Page from an American History Textbook to George Lucas’ Lucas Museum of Narrative Art.

In short, there’s a growing array of influences behind recent trends within the art world, and when those factors shock those within the industry, change is clearly in the air.

NFTs: Soaring, or Suffering From Primate Ennui?

Whether you see digital assets as the wave of the future or approach them with a more skeptical eye, there’s no discussing today’s collector market without checking in on Non-Fungible Tokens. At this moment, the market has lost some of its late-2021 frenzy. Ethereum, the blockchain behind most NFTs, has cratered to less than half of last fall’s value as of this writing, and as a result many new NFT launches have been delayed.

“Ninety five percent of NFTs will fail,” said Greg Adams, Digital Asset and NFT Specialist for the Fine Art Group. “That’s an accurate stat. It’s not for the faint of heart. A lot of people look at it as almost a gambling experience. Creators see a successful NFT minting as the equivalent of going viral.”

Nevertheless, Adams says digital assets are now a permanent fixture in the art world. He indicated there’s an ever-growing influx of established artists to the digital space, and traditional investors are slowly beginning to follow suit. “The original people getting into NFTs were those who had been in crypto for a while. As more artists come over, buyers are getting more comfortable with the concept,” he said. “The more an artist has a good cause or concept, the more buyers are willing to be a part of that.”

Meanwhile, Adams notes that no one medium has a monopoly on dramatic market fluctuation, pointing to his colleague Heriot’s comments about the traditional art market. He could just as well have cited a few volatile cars, too.

Adams also pointed out how marketing-reliant NFT projects can be. As with everything in our social age, influencers have played a key role in the rise of digital assets. Perhaps unsurprisingly, influencers in the collector world don’t silo themselves to one item, whether NFTs, art, sneakers, or cars. In fact, there’s quite the convergence among sneaker/streetwear trendsetters and promotors of digital art. DJ Steve Aoki is a known sneakerhead who has partnered with brands like Zegna and Vision Streetwear to create his own shoe designs. He’s also heavily involved in the NFT world, owning some “Bored Apes” and selling an NFT entitled “hairy” for $888,888.88 last year. Bobby Hundreds, founder of The Hundreds streetwear, has touted this year on NPR and other outlets how his company is integrating NFT use into their product line. Despite the early adopter fanfare, it’s worth pointing out that while the added interest generated by these entrepreneurs is no doubt lucrative to their own bottom lines, it hardly mitigates the risk to the average NFT neophyte.

“Wild West” remains the best encapsulation of digital assets at this point. Absent any steps toward regulation (nothing is on the horizon), NFTs aren’t going anywhere—in fact, they’re likely to continue to infiltrate into other collector segments. If you want to play in this world, our own Jack Baruth shares a note of caution, and Adams preaches the following: “take your time, do your homework, and your safest bet is to stick with known artists or creators.”

Speaking of Shoes…

We touched on the overlap between sneakers and other collector markets, and to further solidify the point, Nike sold a NFT of a sneaker this past April for $134,000. But for those who are interested in actual shoes, what’s going on in the sneaker market?

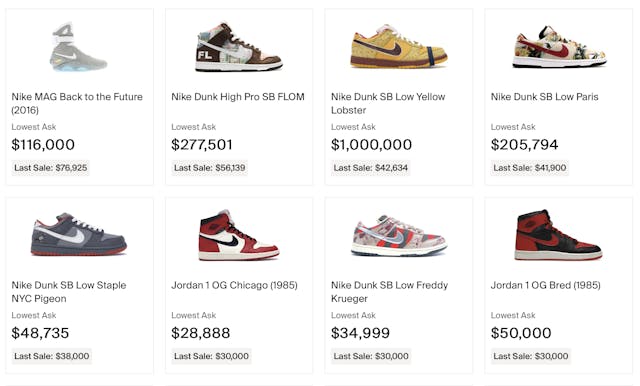

It won’t come as a surprise that the shoe market has seen its share of massive sales recently. A pair of Kanye West’s Nike Air Yeezys sold privately by Sotheby’s for $1.8M in April of 2021. Also at Sotheby’s, a pair of Michael Jordan’s game-worn Nike Air Ships became the most expensive shoes ever to sell at auction, going for $1.47M last October. More interesting, though, is what’s happening at a less stratospheric level.

Like the majority of the collector car market, people buy sneakers—even the special ones— to use. As with putting miles on cars, once you’ve worn a sneaker, it no longer has “as new” value. StockX, a marketplace for collector items like shoes, electronics, and, of course, NFTs, only sells sneakers that have not been worn. When someone makes a purchase, they’re keeping demand up for that given shoe, and when they step out in their new kicks, that’s one more pair removed from the supply. This generally keeps a floor on price volatility.

Oddly, it’s manufacturers that occasionally drop a bomb on the collector shoe market values by reissuing a particular model. Kanye West’s Yeezy brand leverages the interest generated by the secondary market by reissues via its Yeezysupply site. Nike and other brands have the same practice—it’s not uncommon, and enables companies to get a second bite at collector enthusiasm, even if it tanks values for those who already own the shoe. Personally, especially in light of recent values, I would love for Chevrolet to offer a reissue of “new” C2 Corvettes—I’ll take my L88 in Goodwood Green over a Saddle interior, please.

Checking into the latest listings on StockX, there’s a fair amount of similarity to some recent behavior we’ve seen in the car market: people still appear to be buying for high- and sometimes record numbers, and there are an ample amount of seller listings for large (perhaps excessive) percentages above prior sales. Like the car market, tracking prior sales (like shown above) and average length of listing can give an idea whether buyers will assent to these prices or bring sellers down from their dizzying heights in the coming months.

Compared to NFTs and art, the sneaker market appears downright straightforward. Yes, there are influencers who impact values, and on occasion a manufacturer will reissue a shoe, but this market appears to still accommodate buyers who want to enjoy their hobby by buying what they like at their price point and using it.

Collect what you love, and you won’t be disappointed…but be careful

After canvassing experts in the fields of art, NFTs, and sneakers, my main takeaway is that I don’t know nearly enough to become a serious collector of art, NFTs, or sneakers. That may sound trite, but it’s actually a key insight—and perhaps advice worth passing along to any car-agnostic friends who suddenly think it’d be neat to make a quick buck on Bring a Trailer. Macro trends matter—that’s why we talk about demographics and economics around here—but so do the details of what you’re buying. That’s doubly true in times of uncertainty. Unless you have the financial bandwidth to buy what you want whenever you want it, today’s collector markets require a good deal of research, time, and diligence.

***

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.