2022 from across the pond

The past year represented something of a return to normalcy for the United States. It most certainly did not for the United Kingdom. In 2022 we saw the cost of living soar amidst governmental instability, exchange rates between the British pound and other currencies fluctuate like a rollercoaster, and the first land war in Europe for thirty years impacted pretty much everything in the motoring world, from gas prices to parts availability. That, and the U.K. is still coming to terms with leaving the EU and all the new red tape that entails. So, the outlook for the classics and collector car hobby during this gathering recession would be bad, right? Wrong. This year has been crazy on many levels. Here are my headlines of what’s been going on in the UK and Europe in 2022.

Nearly every metric increased

From the price of the most expensive car on the planet (now the $142M Mercedes-Benz Uhlenhaut Coupe, sold in Germany in May) to the number of people accessing the UK Hagerty Price Guide (up over 12%), 2022 was a bumper year. Auction sales were up, too; Hagerty tracked over 15,500 UK classic vehicle auction lots sell this year, up from 14,000 in the same period in 2021, an 11% uplift. The total value of auction sales rose from £270M to £303M ($327M to $368M), around a 12% increase year over year. Hagerty’s analysis has suggested that recessions often encourage people to spend money on cars as they search for a release and somewhere tangible to put their money, and this time seems no different. The only slightly worrying sign is that, towards the end of the year as interest rates grew, auction houses told us that their sellers were more likely to set lower reserves than they had been previously, especially at the enthusiast (sub-£50,000, or $60,000) end of the market. Even so, we still saw the overall auction sale rate drop slightly, down from 79.3% to 76.2%. As home fuel bills rise again over the winter, it is not surprising that sometimes the car in the garage may have to be sold.

The top of the market is booming …

We have to face it: while many enthusiasts have been tightening their belts, many of those with money are seeing the oncoming recession as more of an opportunity than a threat. Inflation, interest rate rises (with more forecast) and a strong dollar/ weak pound have combined to make UK collector cars a great place to put money. That said, Hagerty’s analysis hasn’t shown an increase in pre-1990 cars shipped from the UK to the US; we believe that export costs and taxes mean that it’s more sensible for many overseas collectors to leave their cars here and use them during trips. Comments from storage companies support this.

… but a few big collectors have cashed out

This year, Hagerty has observed a number of big collections come onto the market. The Gran Turismo collection offered at the RM Sotheby’s London auction in November was the most remarkable: 19 of the most collectible modern classic supercars including the whole Ferrari halo car set of 288 GTO, F40, F50, Enzo and LaFerrari. No less than six of these cars featured in the top ten of all cars sold at live public auction in the UK this year, and the collection netted around £22M ($26M) for its previous owner, a well-known UK enthusiast. Less valuable but no less remarkable was the Bavarian Legends collection, also sold by RM Sotheby’s in November, this time in Munich, Germany. Thirty two exceptional BMW cars were offered by a notable Hong Kong collector, with 19 of them selling for at least double their low estimate. One of the most incredible was a 2752-km from new 1997 E36 BMW M3 Evo that sold for €286,250, about ten times Hagerty’s top value of £25,700 ($31,200). So, why have these and a few other collectors parted with their cars? My analysis is that it isn’t about belt tightening—it’s about freeing up cash to buy other things, maybe different cars, maybe property. Despite the impressive nature of both of these major collections, we believe that the collectors own a number of even more remarkable cars; these, believe it or not, were the ones they felt they could replace if needs be in the future.

Mileage matters …

As we saw with the BMW E36 M3, modern collectibles with ultra-low mileage have been keenly fought over and often achieved extraordinary prices. Cars in this category as diverse as a 2010 Ford Focus RS500 to a 2009 Mercedes-Benz SLR McLaren 722S Roadster broke records, the first selling for a huge £99,000 ($120,000) at Silverstone Auctions in November, Bonhams selling the latter for £679,166 ($824,830), more than double top estimate at the Goodwood Revival Sale. These cars likely won’t be driven—just stored and sold again in a few years’ time, making them very attractive to anyone who wants the investment of a car without the “hassle” of actually driving it. Yep, those folks are actually out there.

… and so does celebrity ownership

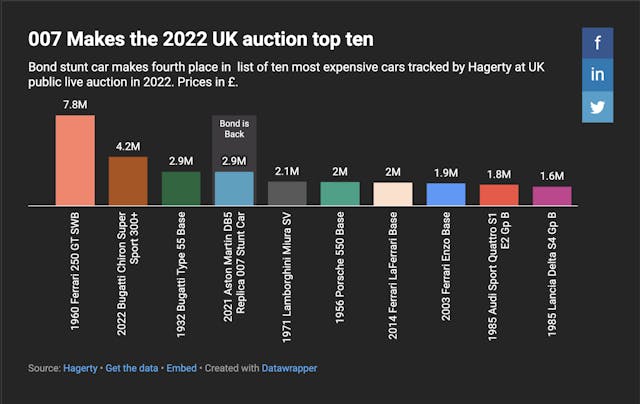

As Hagerty showed when it published its first Power List earlier this year, celebrity ownership can add a huge amount of value to a car. In 2022, there have been some great examples of this. A rather unloved 1974 Rolls-Royce Silver Shadow (Hagerty Price Guide around £10,800, or $13,166) sold for a massive £286,250 ($347,643) thanks to its first owner being Freddie Mercury of the band Queen. In September, Christie’s sold an Aston Martin DB5 replica, a stunt car used in the James Bond movie No Time to Die for £2.92M ($3.54M), ranking fourth on our top ten of public live auctions, the first time a replica has appeared on the list. Then, most impressive of all, a 1985 Ford Escort RS Turbo that had been built by Ford’s Special Vehicle Engineering department for Diana, Princess of Wales, sold for £722,500 ($877,458). That’s huge: Ferrari Daytona money for a Ford Escort, and nearly 20 times Hagerty’s top value for the model of £35,400 ($42,992).

Competition cars are still very popular …

The most expensive car sold at UK public auction in the UK was a racing car: a 1960 Ferrari 250 GT SWB Competizione sold for £7,762,500 ($9,427,362). For the second year in a row, an Audi Sport Quattro also appeared in the top ten, joined by another rally legend, a 1985 Lancia Delta S4 Group B car. F1 cars have also been crossing the block a lot this year, including an absolute racing gem of a car: the Ferrari F2003 GA that was driven by Michael Schumacher to five victories during his sixth championship-winning year in 2003. It sold in Geneva for 14.63M Swiss francs, around $15.7M. That said, there are F1 cars and F1 cars… only those with the right drivers and performance attached will gain high prices: two Force India cars sold at this year’s Revival made £78,000 ($94,730) and £69,000 ($83,800), respectively. Those will never be worth millions. What does Hagerty forecast? Just as Mercedes-Benz saw the importance of selling one of the gems of its fleet, maybe this will price a few more really special F1 cars out of other manufacturers’ collections.

… but people just want to have fun

Hagerty believes that one reason why ultra-rich collectors prize competition cars so highly are that they give them access to the very best events on the planet. You want to be invited on the Mille Miglia or to show your car at The Amelia? A very special racing car that was once driven by an ace driver will help your case. But everyone, regardless of pocketbook size, loves a good show: this year, we launched the Hagerty Series in the UK, a set of three keystone events owned and run by Hagerty for enthusiasts: the Festival of the Unexceptional, a celebration of base model cars that used to be on everyone’s driveways, the Hagerty Hillclimb at the historic Shelsley Walsh track and UK RadWood. Elsewhere, we partnered with some other fantastic new events including the Savile Row Concours in London, sent judges to the Valetta Concours (Malta), Salon Privé, and the Goodwood Festival of Speed. All were extremely well attended and our feedback was astonishingly positive. In a time when extraordinary challenges are facing a huge number of people, it comes back to this: cars give us freedom, they give us pleasure, they give us community. Long may it last.

__

John Mayhead is editor of the UK Hagerty Price Guide.

***

Check out the Hagerty Media homepage so you don’t miss a single story, or better yet, bookmark it. To get our best stories delivered right to your inbox, subscribe to our newsletters.