Is the classic car market due for a correction in 2014?

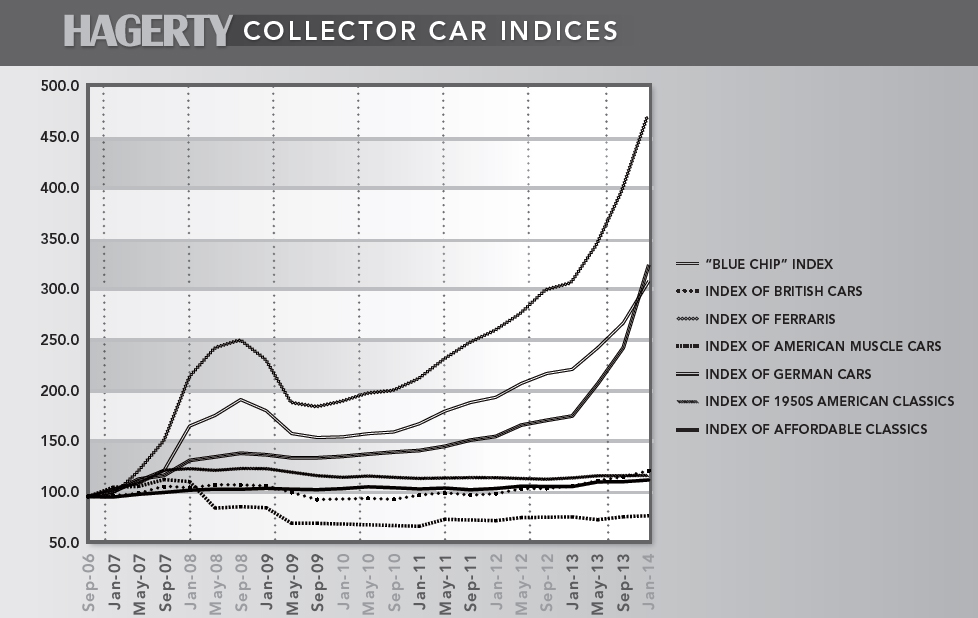

The Hagerty Price Guide recently published values from Book 23 and, in some respects, the song remains the same. Top-tier indices like our Blue Chip Index and Ferrari Index accelerated for the fourth consecutive period. Our postwar German Index was even more stunning, doubling up on last period’s 16% clip by posting gains of 32%. The German Index improved by 81% during 2013. For the most desirable cars, the market has rarely been stronger.

This continued growth of the market is bringing with it attention from far and wide. Each successive major public auction seems to set a new record of one stripe or another, and even circles outside of the car world are marveling at the numbers ($27.5M for a Ferrari! $3M for a Corvette!). With this increased attention (and possible participation of inexperienced buyers), there is a sizeable opinion among market observers that the current pace is set for a course correction this year. How big a correction is hotly debated with viewpoints ranging from “relaxing growth” to “pop!” Few pundits, on the other hand, are indicating that these cars will leap farther forward than they did in 2013. For what it’s worth, we believe that prices will continue to grow, but at a slower pace than what was recorded this past year. Furthermore, we feel this is a good thing.

For the cars that most collectors drive and own, the cars that are most popularly traded, slow and steady is the pace. Hagerty’s British Car Index was the biggest mover outside of the three major indices we have already mentioned, and it increased by 5%. Otherwise, American Muscle, 1950s American, and Affordable Classics all stood pat or inched up a point. Turns out that there are still plenty of great cars available at affordable prices, or at least at prices that aren’t head and shoulders above where they were five years ago, and these cars have shown to be relatively “safe” places to spend some money.

January is held up as the bellwether for the collector car market, with Scottsdale and now Kissimmee sales setting the tone for what will follow. Whether this is true or not, the clues will start to be cast in just a few days, and then the market will feverishly begin to make sense of them.