When excise tax feels like “excess” tax

There are all sorts of expenses associated with owning a bunch of cars—and by “a bunch,” I mean “more than a reasonable person would have, but not so many that you’re clearly a moneyed collector.”

Obviously, there’s the purchase cost of the cars themselves, but that’s a one-time whack. There’s garaging, which can be a single-time cost if you own your home/garage or outlying warehouse, or it can be a monthly expense if you rent. There’s insurance, which, thanks to Hagerty, is incredibly affordable for the mid-valued cars that comprise most of my not-a-collection. There’s maintenance and upgrades, which can financially ruin you if you restore, seek perfection, or just keep endlessly messing with the cars. And there are relatively modest costs such as annual state inspection, if your state requires it.

But one of the funny expenses, at least to me, is the annual excise tax that we have here in Massachusetts. This is a distinct thing from sales tax, which is assessed once by the state when the car is purchased, titled, and registered. Excise tax is state-wide, but it’s assessed by the city or town in which you live and goes into their coffers, not the state’s. (Note that none of what follows below is an anti-tax rant. I love my home state of Massachusetts and don’t mind paying my fair share to fund some of the best public schools and social safety nets in the country.)

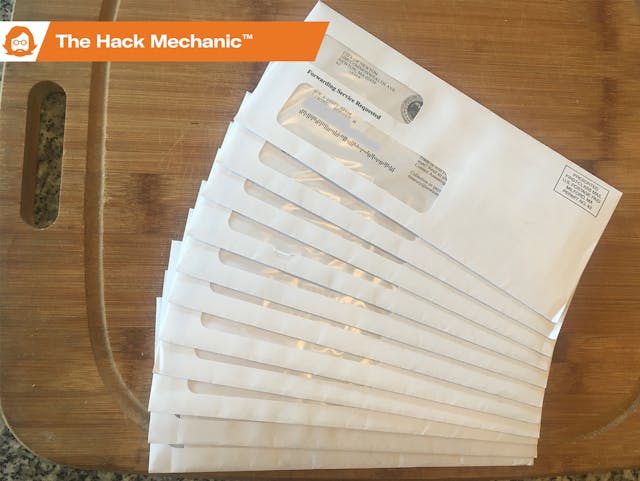

There are two funny things about excise tax. The first is that, for some reason, the bills for most of my 12 registered cars always arrive in the mail on the same day, so unlike inspections, which are staggered because the annual stickers expire on the anniversary of the car’s registration date, it’s always a reminder that I own a lot of cars. You might as well call it the “excess tax,” because when that flood of envelopes comes, that’s what it feels like—a big slap in the face making me confront my own excesses.

The other thing is how the excise tax is assessed. The mass.gov website says, “The excise rate is $25 per $1000 [2.5 percent] of your vehicle’s value. Your vehicle’s value for excise purposes isn’t the actual purchase price or “book value” of the vehicle. Instead, it’s a percentage of the manufacturer’s list price in the year of manufacture.” This is an important distinction, because when you first register a car in Massachusetts, you are assessed a one-time 6.25 percent sales tax on the car’s book value, and the “book” they use is the NADA Guide, which is well aware of the appreciating values of vintage cars—and you get whacked for taxes if you, say, buy a dead, rusty car for $2500 whose low “book value” is $25,000.

But with excise tax, the Massachusetts government website uses the following table:

According to the table, the taxable value of a car bottoms out in the fifth year and remains fixed after that. So, if you think about it, it’s sort of like taking the situation with the state motor vehicle sales tax and turning it on its head. That is, unlike sales tax, where you’re penalized if you buy a needy example of a car whose value has substantially appreciated, the car’s current value is irrelevant with excise tax. All that matters is what it cost when it was new and whether it’s at least five years old.

So, you’re rewarded if you buy cars that were cheap when they were new (which is generally the case with older cars) and penalized on newer cars that had high manufacturer’s suggested list prices (MSRPs).

Let’s give some examples. If your passion is 40–50-year-old cars that cost, say, $4000 when they were new, their taxable values (according to the table) bottom out at 10 percent of that, or $400, and the assessed 2.5 percent tax on that value is only $10. So, even if you owned 12 of these cars, the annual excise tax whack would only total $120. Peanuts.

However, let’s say that your passion is 30-year-old German cars. A 1988 BMW E28 535i sedan cost about $35,000 new. The bottom-out 10 percent value would be $3500, and 2.5 percent of that is $87.50. That’s an easy bill to swallow for one car, but if you’ve got 12 of them, it adds up.

You can see what happens with flagship cars that were very expensive when they were new. On the one hand, depreciation is a wonderful thing and allows V-12 cars like a 1990s-era BMW 850i or a Mercedes SL600 (that cost more than $100K when new) to be purchased now for peanuts. But remember that the Massachusetts excise tax is based on the original MSRP value. For a $100,000 car, the five-year bottom-out value is 10 percent of $100K, or $10,000, and you’re assessed 2.5% percent of that, or $250. Every year. For as long as you own the car. For each car.

It wouldn’t prevent me from buying an 850i six-speed if I found one cheap, but you can see how, with multiple cars, it can turn into real money.

Just for fun, let’s extrapolate this out to a logical endpoint. The Bugatti Veyron reportedly had a base price of about $1.3 million. If you could afford that, I suppose you’d have no problem affording the initial 6.25 percent Massachusetts sales tax of $81,250. The excise taxes then spin out as $29,250 in year one, $19,500 in year two, $13,000 in year three, $8125 in year four, and finally bottoming out at $3250 in year five and thereafter. (I was never a big Top Gear junkie, but I’ll always remember their review of the Veyron, when James May said, “We’re getting close to the maximum [speed], which means the tires will only last for about 15 minutes. But it’s OK, because the fuel runs out in 12.”)

So, let’s see how this works out with my quirky assemblage of cars. This year, excise tax bills for nine of the 12 cars arrived on the same day (my Winnebago Rialta RV is currently off the road and thus is not taxed; I haven’t yet received the bill for my recently-repurchased and re-registered BMW Z3; and my Lotus Europa is registered in Vermont). I’ve organized it by year, with the newest cars first. The “assessed value” and “excise tax” columns are taken from what is printed on each tax bill. I’ll discuss what I mean by “base value” in a moment.

The car with the highest annual excise tax is the newest and originally the most expensive. The one that’s ostensibly my daily driver—my 200,000-mile 2003 BMW E39 530i stick sport—cost me $102.50 every year I own it. The assessed value of the car is listed as $4100, which is high. A dead-nuts mint one might be worth that; E39s aren’t worth much. But when I look up what the new cost of a 2003 BMW 530i was, I see that it’s listed as $41,100. Since the assessed value is supposed to bottom out after five years as 10 percent of the MSRP, $4110 is exactly right. This is how I’ve created the “base value” column—I’ve simply multiplied the “assessed value” on each bill by 10 to back-calculate what they (and “they” is whatever database they’re drawing the information from) think was the original MSRP of the car.

Likewise, looking up the new cost of my wife’s little 2013 Honda Fit stick sport, I find that it retailed for $17,160, so the excise tax and its base value are just about spot-on (although $1706 is very low for the car’s current value).

And then it gets a bit weird. My 1979 BMW 635CSi is a gray-market European car, so who knows where they’re drawing their data from, but I’m grateful for the low annual $12.50 tax.

The values of two of my BMW 2002s—the ’73 and the ’75—seem to be off by quite a bit. 2002s were a bit pricey when they were new, but the $11,730 to $14,250 base values are high by nearly a factor of two. I’m not the original owner of my ’75, but I actually have the window sticker, and it was priced at $6,800. The ’72 2002tii and the ’72 Bavaria are closer, as new, they both stickered at about $5,500. Still, I’m not complaining about the excise taxes on any of them.

For my ’73 3.0CSi, it’s actually not too far off. Ignoring for a moment that my CSi was a European-only gray market car, the original MSRP of a U.S. Federal-spec 3.0CSi was about $10,000. As I now have the car insured with Hagerty for $60,000, I’m grateful that the excise tax calculation for the state of Massachusetts values it at about 1/60th of that.

You probably noticed that I jumped over the 1999 BMW Z3 M Coupe (a.k.a. “the clown shoe”). The MSRP of the car was $41,800—nearly identical to the 2003 530i—so after five years it should bottom out, excise-tax-wise, to the same amount, and I should be charged about $100 a year as I am for the 530i. Instead, for reasons absolutely unknown, as long as I’ve owned the car, they’ve assessed me on a value of $1430 and annually billed me $35.75. Don’t tell them that it must be a mistake. We’re all friends here, right?

So, a total of $326.22 for the annual excise taxes on these nine cars. As the price of excess goes, really, that isn’t bad.

Perhaps I could buy a few more cars and still not be a “moneyed collector.”

***

Rob Siegel has been writing a column (The Hack Mechanic™) for BMW CCA Roundel magazine for 34 years and is the author of seven automotive books. His new book, The Lotus Chronicles: One man’s sordid tale of passion and madness resurrecting a 40-year-dead Lotus Europa Twin Cam Special, is now available on Amazon (as are his other books), or you can order personally-inscribed copies from Rob’s website, robsiegel.com.